Contents

🔴 3 Minutes! CAPM Finance and the Capital Asset Pricing Model Explained (Quick Overview)

นอกจากการดูบทความนี้แล้ว คุณยังสามารถดูข้อมูลที่เป็นประโยชน์อื่นๆ อีกมากมายที่เราให้ไว้ที่นี่: ดูความรู้เพิ่มเติมที่นี่

omg Wow! So easy clicked here https://www.youtube.com/watch?v=gzxKd2S2MdU for CAPM or Capital Asset Pricing Model

If You Like My Free Videos, Support Me at https://www.patreon.com/MBAbull

Imagine you have a friend named Bob with his money safely deposited in a bank at a 5% interest rate per year and that you have a scary and risky company which also earns an average 5% profit for owners or investors per year. Can you convince Bob to withdraw his money from the bank and invest in your business? No way! If your business is riskier than the bank, then Bob would want an average return much bigger than 5%. Now what if…

Bob also has some money invested in the general stock market, which is kinda risky, but not as risky as your scary company… and he earns an average profit of 8% per year. Can you offer Bob also 8% to convince him to sell his stock market portfolio and invest in your company instead? Again, no way! If your company is riskier and scarier than the general stock market, then you would have to offer Bob an average return higher than 8%, to reward Bob for his higher risk. http://www.youtube.com/watch?v=gzxKd2S2MdU So the question now is… exactly how much average % return should you offer Bob, to make his investment worth his risk in your scary company? This % is called your \”cost of equity\”… and we calculate it using the CAPM or Capital Asset Pricing Model Formula. The Capital Asset Pricing Model or CAPM formula factors in Bob’s risk and return from his other investments, and then tells us how much Bob should reasonably expect from your riskier company. That’s why your \”cost of equity\” is also called your investor’s \”expected return.\” Would you like learn the CAPM with more analysis and detail as well as how to calculate it the EASY way? Check out my free stepbystep tutorial video and download my free cheatsheet on CAPM at MBAbullshit.com. See ya there!

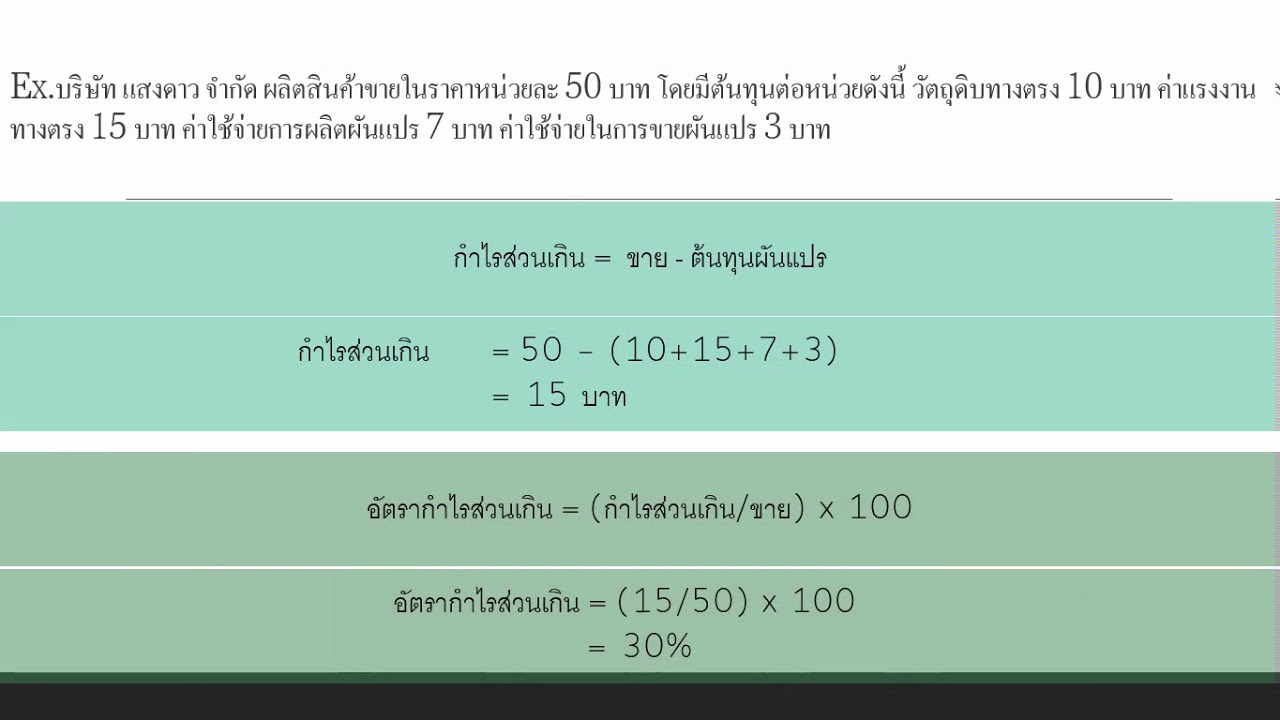

การวิเคราะห์ต้นทุน ปริมาณ กำไร

งบลงทุน การพิจารณาโครงการลงทุน เครื่องมือเลือกโครงการ NPV IRR MIRR PB PI คืออะไร

การจัดการการเงิน การหาค่า WACC ต้นทุนเงินทุน

BUS6010 เศรษฐศาสตร์ การหาความสัมพันธ์ของ TP AP MP อธิบาย Law of Diminishing Returns

Law of Diminishing Returns

กฎผลตอบแทนลดน้อยถอยลง หรือ Law of Diminishing Returns คือ การที่เมื่อเพิ่มทรัพยากรเข้าไปในการผลิตในระยะแรกจะทำให้ได้ผลผลิตพิ่มมากขึ้น และเมื่อเพิ่มทรัพยากรไปเรื่อยๆจนถึงจุดหนึ่งจะไม่ทำให้ผลผลิตเพิ่มขึ้น และในระยะสุดท้ายการเพิ่มทรัพยากรเข้าไปจะทำให้ผลผลิตที่ได้ลดน้อยลง

นอกจากการดูหัวข้อนี้แล้ว คุณยังสามารถเข้าถึงบทวิจารณ์ดีๆ อื่นๆ อีกมากมายได้ที่นี่: ดูวิธีอื่นๆTECHNOLOGY