You are looking for information, articles, knowledge about the topic nail salons open on sunday near me how much is 2x on Google, you do not find the information you need! Here are the best content compiled and compiled by the https://chewathai27.com team, along with other related topics such as: how much is 2x what does 2x return mean, what is 100x return, 2x growth meaning, how much is 100x in percentage, 1x profit meaning, how to calculate 10x in crypto, what is 2x 3x in crypto, 2x return on investment

Contents

What does 2x mean in money?

or, when we insert the investment returns discussed in the example above, it looks like this: (40,000 + 60,000) / 100,000 = 2. That’s what it means to have an equity multiple of 2x. You’ve increased your original investment by a factor of 2. In other words, you’ve doubled your money.

What is 2x growth?

2x is referred to as having “doubled” your original quantity. There is no similar expression that covers this. Some might be inclined to say that 2x is a two fold increase, so wouldn’t 10x be a tenfold increase? Yes it would, but to get 10x, you must have x + 9x. That would be x + 9.00 * x.

What does 10x return mean?

Obviously, the way to calculate a return multiple is to divide the amount returned from an investment by the dollars invested. If I invested $10M in a company and got back $100M, that’s a 10X return.

What percent increase is 10x?

what does this mean? 10x means to maximize and expand your results ten times over, rather than just by 10%.

What 2X means?

| Acronym | Definition |

|---|---|

| 2X | Double Extra Large |

| 2X | Two Times; Twice |

Is 2X the same as 200%?

200% of something represents a doubling of the value: 2x. A 200% change in something represents a tripling of the original value: x + 2x = 3x.

Is 100% gain a 2x?

Yes, the correct usage is that 100% increase is the same as a two-fold increase. The reason is that when using percentages we are referring to the difference between the final amount and the initial amount as a fraction (or percent) of the original amount.

Is 200% a double?

An increase of 100% in a quantity means that the final amount is 200% of the initial amount (100% of initial + 100% of increase = 200% of initial). In other words, the quantity has doubled.

How do I calculate a 200% increase?

Subtract the original value from the new value, then divide the result by the original value. Multiply the result by 100. The answer is the percent increase. Check your answer using the percentage increase calculator.

What is a 3x return?

Returns can also be expressed as a multiple of the fund the investment came from. For a $100M venture fund that has returned $300M, the multiple for the fund would be expressed as “a 3X return cash on cash.”

What does 5x mean in stocks?

A P/E of 5x means a company’s stock is trading at a multiple of five times its earnings. A P/E of 10x means a company is trading at a multiple that is equal to 10 times earnings. A company with a high P/E is considered to be overvalued.

What does 20X mean in stocks?

A stock trading at 20X earnings has a share price 20 times the current or previous year’s net earnings per share. Video of the Day.

Is 100X the same as 100%?

100X=100%? – (Mar/30/2005 )

It’s Triton-X100… the number is not a reference to concentration… after all there is Triton-X114… So the X and the 100 are only the name of the product. If you want a 2% solution you take 2ml in 100ml final, like any other product. 50 x means 50 times what is concidered normal for use.

What is 10X mean?

| 10X | |

|---|---|

| Definition: | Thanks |

| Type: | Abbreviation |

| Guessability: | 3: Guessable |

| Typical Users: | Adults and Teenagers |

What percent is 20X?

So the improvement was 9 divided by 10, which equals 0.90 or 90%. That is even better than our first correct example which yielded a 75% improvement. It is interesting that a 20X claim is really a 95% improvement, 100X is 99%, and 200X is actually 99.5%.

What does 1c mean in money?

USA. 1 US Dollar = 100 cents. 1c.

What is two C’s in money?

$100 bill is occasionally “C-note” (C being the Roman numeral for 100, from the Latin word centum) or “century note”; it can also be referred to as a “Benjamin” or “Benny” (after Benjamin Franklin, who is pictured on the note), or a “yard” (so $300 is “3 yards” and a $50 bill is a “half a yard”).

How much money is an M?

M is the Roman numeral for thousand and MM is meant to convey one thousand-thousand — or million. To take it further; one billion would be shown as $1MMM or one-thousand million.

What does W mean in money?

A symbol appearing next to a security listed on NASDAQ indicating that the security is a warrant. All NASDAQ listings use a four-letter abbreviation; if a “W” follows the abbreviation, this indicates that the security being traded is a warrant.

What does 1x, 2x, and 10x mean as percentages?

- Article author: www.chrisjmendez.com

- Reviews from users: 17806

Ratings

- Top rated: 4.4

- Lowest rated: 1

- Summary of article content: Articles about What does 1x, 2x, and 10x mean as percentages? Updating …

- Most searched keywords: Whether you are looking for What does 1x, 2x, and 10x mean as percentages? Updating

- Table of Contents:

Sign up for more like this

List of favorite AI-assisted Content Generators

How to stop Universal Audio (UA Audio) mini application manger from launching at startup

Transcribe Web3 lingo using Custom Vocabularies within AWS

What Equity Multiple Means For Passive Investors

- Article author: goodegginvestments.com

- Reviews from users: 6603

Ratings

- Top rated: 4.7

- Lowest rated: 1

- Summary of article content: Articles about What Equity Multiple Means For Passive Investors Updating …

- Most searched keywords: Whether you are looking for What Equity Multiple Means For Passive Investors Updating Learn what an equity multiple is, how it’s calculated, and how it helps you evaluate real estate syndication investment opportunities.

- Table of Contents:

What Is Equity Multiple In Commercial Real Estate

The Equity Multiple Calculation

Why You Shouldn’t Rely Solely On Equity Multiple When Evaluating Private Investments

How Goodegg Looks At Projected Investment Metrics

In Preparation For Your Initial Investment In A Commercial Real Estate Syndication

Want to stay in the loop Subscribe to the Goodegg Scramble Newsletter

Ready to build true wealth for your family

Want to work with us

Recent Posts

Learn about passive investing

Questions We’re here for you!

Check out our latest updates on Instagram

Listen to our latest podcast episodes

Error 403 (Forbidden)

- Article author: www.quora.com

- Reviews from users: 2391

Ratings

- Top rated: 4.7

- Lowest rated: 1

- Summary of article content: Articles about Error 403 (Forbidden) Updating …

- Most searched keywords: Whether you are looking for Error 403 (Forbidden) Updating

- Table of Contents:

How Hard is it to Earn a 10X Return on Investment? – Scale Finance

- Article author: scalefinance.com

- Reviews from users: 41541

Ratings

- Top rated: 4.1

- Lowest rated: 1

- Summary of article content: Articles about How Hard is it to Earn a 10X Return on Investment? – Scale Finance Updating …

- Most searched keywords: Whether you are looking for How Hard is it to Earn a 10X Return on Investment? – Scale Finance Updating Source: Rob Go, Cofounder, NextView Ventures Every time I see blog posts referencing multiples on VC investments, I wonder if writers or readers appreciate how hard it is to generate these kinds of multiples and how multiples should really be calculated. Obviously, the way to calculate a return multiple is…

- Table of Contents:

Primary Sidebar

Secondary Sidebar

Footer

10x vs 10%: Grow Your Business the Agile Way

- Article author: blog.modthink.com

- Reviews from users: 31396

Ratings

- Top rated: 3.8

- Lowest rated: 1

- Summary of article content: Articles about 10x vs 10%: Grow Your Business the Agile Way Updating …

- Most searched keywords: Whether you are looking for 10x vs 10%: Grow Your Business the Agile Way Updating Agile 10x marketing maximizes your performance the agile way; by pursuing 10 times the growth, rather than just 10% growth.

- Table of Contents:

Introducing 10x and 10%

Where is the Gap

So Why 10x

Breaking Down Your Transition to 10x

Recent Blogs

Error 403 (Forbidden)

- Article author: www.quora.com

- Reviews from users: 16013

Ratings

- Top rated: 4.6

- Lowest rated: 1

- Summary of article content: Articles about Error 403 (Forbidden) That equals 2x. The proper equation is x + 100% of x. 100% , expressed as a decimal is 1.00 The proper way to express that is x + 1.00 * x = x + x = 2x. …

- Most searched keywords: Whether you are looking for Error 403 (Forbidden) That equals 2x. The proper equation is x + 100% of x. 100% , expressed as a decimal is 1.00 The proper way to express that is x + 1.00 * x = x + x = 2x.

- Table of Contents:

What does 2x means? How much is 2x? – ForNoob

- Article author: fornoob.com

- Reviews from users: 2313

Ratings

- Top rated: 3.3

- Lowest rated: 1

- Summary of article content: Articles about What does 2x means? How much is 2x? – ForNoob It means that you need two of that item. · 2x means two times. multiplied by 2 · x is a variable and could mean any number. 2x where x=5, is 10. …

- Most searched keywords: Whether you are looking for What does 2x means? How much is 2x? – ForNoob It means that you need two of that item. · 2x means two times. multiplied by 2 · x is a variable and could mean any number. 2x where x=5, is 10. What does 2x means? How much is 2x? – What does 2x means when somebody says “I need 2x things like bottles, ads, computers etc”. How much 2x means?

- Table of Contents:

Recent posts

Trending

About

ForNoob

Connect with us

Attention Required! | Cloudflare

- Article author: www.toppr.com

- Reviews from users: 3374

Ratings

- Top rated: 4.0

- Lowest rated: 1

- Summary of article content: Articles about Attention Required! | Cloudflare Click here to get an answer to your question ✍️ By how much is 2x – 3 y + 4z greater than 2x + 5y – 6z + 2 ?By how much does 1 exceed 2x – 3y – 4 ? …

- Most searched keywords: Whether you are looking for Attention Required! | Cloudflare Click here to get an answer to your question ✍️ By how much is 2x – 3 y + 4z greater than 2x + 5y – 6z + 2 ?By how much does 1 exceed 2x – 3y – 4 ?

- Table of Contents:

Please complete the security check to access wwwtopprcom

Why do I have to complete a CAPTCHA

What can I do to prevent this in the future

All the Math You’ll Ever Need: A Self-Teaching Guide – Steve Slavin – Google Sách

- Article author: books.google.com.vn

- Reviews from users: 27199

Ratings

- Top rated: 4.4

- Lowest rated: 1

- Summary of article content: Articles about All the Math You’ll Ever Need: A Self-Teaching Guide – Steve Slavin – Google Sách Updating …

- Most searched keywords: Whether you are looking for All the Math You’ll Ever Need: A Self-Teaching Guide – Steve Slavin – Google Sách Updating A sharp mind, like a healthy body, is subject to the same ruleof nature: Use it or lose it Need a calculator just to work out a 15 percent service charge? Not exactly sure how to get the calculator to give you the figureyou need? Turn to this revised and updated edition of All the MathYou’ll Ever Need, the friendliest, funniest, and easiest workoutprogram around. In no time, you’ll have total command of all the powerfulmathematical tools needed to make numbers work for you. In adollars-and-cents, bottom-line world, where numbers influenceeverything, none of us can afford to let our math skills atrophy.This step-by-step personal math trainer: Refreshes practical math skills for your personal andprofessional needs, with examples based on everyday situations. Offers straightforward techniques for working with decimals and fractions. Demonstrates simple ways to figure discounts, calculatemortgage interest rates, and work out time, rate, and distance problems. Contains no complex formulas and no unnecessary technical terms.

- Table of Contents:

Precalculus – Cynthia Y. Young – Google Sách

- Article author: books.google.com.vn

- Reviews from users: 46017

Ratings

- Top rated: 3.4

- Lowest rated: 1

- Summary of article content: Articles about Precalculus – Cynthia Y. Young – Google Sách Updating …

- Most searched keywords: Whether you are looking for Precalculus – Cynthia Y. Young – Google Sách Updating Engineers looking for an accessible approach to calculus will appreciate Young’s introduction. The book offers a clear writing style that helps reduce any math anxiety they may have while developing their problem-solving skills. It incorporates Parallel Words and Math boxes that provide detailed annotations which follow a multi-modal approach. Your Turn exercises reinforce concepts by allowing them to see the connection between the exercises and examples. A five-step problem solving method is also used to help engineers gain a stronger understanding of word problems.

- Table of Contents:

Using Math in this Millennium 4 Tm – Google Sách

- Article author: books.google.com.vn

- Reviews from users: 40842

Ratings

- Top rated: 4.2

- Lowest rated: 1

- Summary of article content: Articles about Using Math in this Millennium 4 Tm – Google Sách Updating …

- Most searched keywords: Whether you are looking for Using Math in this Millennium 4 Tm – Google Sách Updating

- Table of Contents:

See more articles in the same category here: https://chewathai27.com/toplist.

What does 1x, 2x, and 10x mean as percentages?

As a tech consultant for startups, I often hear people misusing multiples and percentages. As a primer, here’s a simple table showing you what things look like when you buy and sell a company.

Starting Cash Ending Cash Percentage of Return Return Multiple $1M $1M 0% 1x $1M $1.5M 50% 1.5x $1M $2M 100% 2x $1M $3M 200% 3x $1M $4M 300% 4x $1M $5M 400% 5x $1M $6M 500% 6x $1M $10M 900% 10x $1M $20M 1,900% 20x $1M $100M 9,900% 100x $1M $1B 99,900% 1000x

How to Calculate Return on Investment

If you invest $50k into a project and receive $64k, then your Return on Investment is 28%. You calculate this by subtracting the current (or expected) value from the original, then divide again by the original.

For those of you who like algebra, here’s a second way to show the same info.

# Starting Investment investment = $50k # Current (or expected) Value value = $64k # Rate of Return / Return on Investment ror = value / investment # Decimal of Return decimal_ror = ror – 1 # Percentage of Return percentage_of_return = decimal_ror × 100 How to Calculate an ROI

Keep It Simple

Here’s yet another way to present the same information as the table above.

Side-by-Side comparison of Multiples and Percentages

Resources

What Equity Multiple Means For Passive Investors

When you’re reviewing potential commercial real estate syndication investment options, you’ll likely come across the term “equity multiple.” It’s a term that you won’t see when you’re buying a primary home, or even when you invest in rental properties.

While real estate investing is an excellent way to diversify your portfolio, minimize risk, and produce constant returns, in order to get the most out of it, investors must understand how to compare similar investments effectively. Unlike stocks and funds, commercial real estate is a private opportunity asset that does not usually provide the same level of insight into the qualitative factors.

Equity multiple, along with the Internal Rate of Return are two of the most effective calculations to compare the projected total profits of a commercial real estate syndication investment opportunity against the dollar invested.

In the video and blog post below, we’ll cover exactly what an equity multiple is, what you need to calculate equity multiple, and what it means for you as a passive investor.

It’s no secret that commercial real estate syndications have more complicated terminology, an entire list of (potentially confusing) metrics, and an entirely different cash flows procedure than other investments. We’re alongside you in the trenches and can’t let you stall out on your financial freedom journey just because you don’t understand how equity multiple works!

One of our investors shared with us that, after she had a grasp on what an equity multiple was, she was able to more confidently compare projected returns across potential investment opportunities and make wiser investment decisions.

So, here we are making sure that you have a solid resource for such information so that you too can make excellent, aligned investment decisions.

What Is Equity Multiple In Commercial Real Estate?

The term “equity multiple” is actually exactly what it sounds like. It’s the amount that your capital, or your equity, will be multiplied over the course of the projected hold time.

In commercial real estate syndications, the equity multiple is defined as the total cash distributions received from an investment, divided by the total equity invested.

Essentially, it is the amount of money that an investor may earn from their initial capital invested. An equity multiple less than 1.0x indicates that you are receiving back less cash than you put in. Conversely, an equity multiple more than 1.0x indicates that you are getting back more cash than you put in.

So, if a real estate syndication deal had an equity multiple of 2x over a projected hold time of 5 years, that means that you could expect to double your money during that 5 years.

The Equity Multiple Calculation

The equity multiple formula takes into account both the total cash flow distributions throughout the project, as well as the returns on the back end when the asset is sold.

For example, let’s go back to the deal with the 2x equity multiple. Let’s say you were to invest $100,000 into this deal. You want to know how much cash you might make compared to the capital (equity) invested.

Let’s say that this deal has a projected annual return of 8%. That means that you would get about $8,000 per year for 5 years. In other words, you would get about $40,000 in cash flow distributions over those 5 years.

Then, when the asset is sold, you would get your original $100,000 back, plus another, say, $60,000 in profit.

When you take the $40,000 from the cash flow distributions, plus the $60,000 from the sale, you get $100,000 in total returns. So you started with $100,000, and you end with $200,000.

Your calculation for equity multiples should look like this:

Total Cash Distribution / Total Equity Invested = Equity Multiple

or, when we insert the investment returns discussed in the example above, it looks like this:

(40,000 + 60,000) / 100,000 = 2

That’s what it means to have an equity multiple of 2x. You’ve increased your original investment by a factor of 2. In other words, you’ve doubled your money.

Why You Shouldn’t Rely Solely On Equity Multiple When Evaluating Private Investments

Equity multiple measures the total returns over the entire holding period in comparison to the cash you invested and has no measurement for time value or returns per year. This could mean that your returns on an annual basis will vary or that you may have a long period of time before the investment’s absolute return potential is reached.

Remember when I mentioned the Internal Rate of Return back there? Well, if you’re interested in consistent cash distributions over the holding period, and want the time value of money included in your calculations, then you’ll want to explore IRR in addition to equity multiple as part of your due diligence.

All of these metrics should be provided as part of the full investment underwriting process, and in addition to an equity multiple greater than 1.5x, you’ll want to carefully explore the tax benefits, illiquid period, the potential for cash calls, and other risks vs return details, especially on your initial investment.

How Goodegg Looks At Projected Investment Metrics

In the deals that we do, we typically aim for about a 2x equity multiple on your total equity invested over 5 years. This generally means that you can expect to double the cash value of your initial investment after a period of just 60 months.

Now, the sky’s the limit and higher equity multiples are possible, but those deals involve substantial risk. You generally won’t see us offering those as potential investments because risk mitigation and capital preservation are of extreme importance to us.

In other words, we won’t offer you a deal with a good equity multiple solely based on a metric that only measures the total cash distributions received. On deals with an equity multiple greater than 2.5x, it’s likely there are other risks involved with collecting those steep total cash distributions and our conservative underwriting process will come into play.

The important thing to keep in mind is that the calculated equity multiple, just like any projected returns, is projected. That means that the actual returns might not hit that, or they could far exceed that number.

In Preparation For Your Initial Investment In A Commercial Real Estate Syndication

So, now you know what it means for you as a passive real estate investor, how do you know how calculating equity multiple fits in with the rest of the projections you see in the investment summary for a potential real estate syndication deal?

For a walkthrough of a mock deal, be sure to check out our Anatomy of an Investment Summary article. This will provide you a realistic look at a hypothetical investment and all its equity multiple vs internal rate of return details, and other important information you want to know prior to making your first investment in a real estate syndication.

Now that you’ve learned about equity multiple, why it matters to your investments, and how equity multiples are calculated, what will you do next? If you haven’t yet joined the Goodegg Investor Club, what are you waiting for?

It’s free to join and inside you’ll gain access to our past and present portfolio items where you can see all the numbers for yourself!

How Hard is it to Earn a 10X Return on Investment?

Source: Rob Go, Cofounder, NextView Ventures

Every time I see blog posts referencing multiples on VC investments, I wonder if writers or readers appreciate how hard it is to generate these kinds of multiples and how multiples should really be calculated.

Obviously, the way to calculate a return multiple is to divide the amount returned from an investment by the dollars invested. If I invested $10M in a company and got back $100M, that’s a 10X return. Seems pretty straightforward, right?

The problem arises when multiples are inferred from incomplete data. It’s quite rare that anybody but the fund manager actually knows the dollars out and dollars returned by a specific investment. And if you have incomplete data, there are usually a number of things that go into calculating or estimating the return. Here are a few other things to think about.

How to Actually Calculate a Investment Return Multiple

Remember each round of financing further dilutes early investors’ money.

Let’s say a seed investor put in $1M in a company’s first financing round at a $10M post-money valuation. The company ultimately sold for $200M. So, one might infer that the seed investor made $200M/$10M= 20X their money.

Unfortunately, this is almost never the case.

In almost any outcome like this, the company goes on to raise more money, usually at higher prices. As new investors come on board, all existing shareholders of the company will have their ownership stake in the business diluted. This also happens when a company expands their option pool.

Here’s how that plays out for the seed investors.

Let’s say this theoretical company raises just one more round of financing. It’s a $10M round at a $50M post-money valuation. And as part of the round, the option pool of the company is expanded by an additional 10%. After this round, the company has their $200M exit.

In this example, the flow of the math would be something like this: The seed investor owned 10% after the seed financing. In the next round, the seed investor’s ownership is diluted by 30% (20% due the new financing and 10% due to the expanded option pool).

So the seed investor’s ownership was actually 7% at exit. Thus, their $1M returns $14M?—?a 14X return. Pretty great, but meaningfully different from 20X.

Another way to look at it is the effective post-money of the investment. At the seed, the investor bought 10% for $1M. But when it was all said and done, the investor actually bought 7% for $1M. It was like they invested in the company at a valuation of $1M / 7% = $14.3M.

But most companies do not have a straight shot to a multi-hundred million dollar exit with just a seed and Series A. Most raise multiple rounds, and dilution happens at each round.

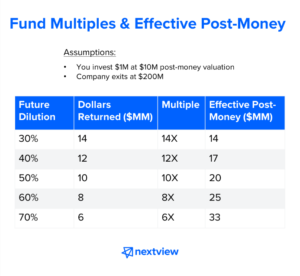

Below is a sample outcome table for a few scenarios.

What this shows is that the investor’s multiple dramatically changes depending on how many rounds of financing occur after the initial round and the level of dilution of each round.

I like thinking about this in terms of effective post-money because it creates a more visceral reaction. If this company goes on to raise multiple financing rounds such that new investors and future employees end up with an additional 50%, the seed investor mathematically invested at a $20M post-money valuation. Still good, but not what you think of as seed-stage prices.

This is why celebrating big financings isn’t always such a great thing. Apart from the screwed-up incentives that can arise from overcapitalized companies, each time a company raises money, all prior investors get diluted, which increases the effective post-money of all the earlier dollars.

Factor in all the dollars an investor puts into a company?—?not just the initial round.

But one might say that this is precisely why it’s important to invest follow-on capital?—?it helps you protect your ownership. This is true, sort of, but leads to another misconception around multiples:

One needs to consider all the dollars someone invests into a company at each round, not just the initial round.

The problem with follow-on financings is that they have a similar effect to future dilution. Each time an investor puts money into a follow-on round, she preserves her ownership, but increases her cost basis and effective post money.

Back to our hypothetical company and angel investor that invested $1M at $10M post. Let’s say that company raises just one more subsequent round of financing that is a $10M at $50M post again. But this time, let’s assume the seed investor decides to “lean-in” and write a $2M check at this stage. So, what happens is:

The investor bought 10% at the seed

The investor also bought another 4% at the Series A

The investor invested $3M total

The investor’s seed dollars got diluted by 30%

So, final ownership is (10% x 70%) + 4% = 11%. Since the investor increased ownership, they basically did “super-pro-rata” in a company they thought was a winner. The company then sells for $200M.

Quick: Is this investment a 10X for the seed investor who initially invested at a $10M post-money valuation?

The answer is NO. The investor made 11% x $200M = $22M. They invested $3M to get there. So it was a 7.3X with an effective post-money of $27M. Pretty good, but not a 10X return.

This effect is even greater if the investor puts capital into multiple future financing rounds, even if they just keep doing their pro-rata share of the round. The example above is simplistic, and I’d argue that 70%+ of $200M exits happen with more future dilution than this.

A Few Takeaways

1) This is why it’s really hard to infer investment multiples from incomplete data.

Someone with only a basic understanding of venture math would think that a seed investor who invests $1M at $10M post would generate a 10X or better return in most $200M exits. But these examples show that it doesn’t take much to turn a 20X scenario into a <10X scenario. And all of the scenarios above assume the future financings are up or flat to the prior rounds. They don’t contemplate what happens if there is a down round or a recap along the way. 2) VCs need bigger exits than you think to drive the 10X returns venture model. When you see data from VCs that talk about 10X returns and the need of 10X returns to drive the venture model, you are probably thinking that the exit size required to generate that 10X is smaller than it really is. Even the 3–5X scenarios require pretty big exits in most cases. This is why there is some misaligned incentives between founders who might find an exit in the hundreds of millions to represent life-changing money and investors who want the company to keep pushing for an even bigger outcome. 3) This is why venture returns often decline as funds get bigger. When a fund is getting started, they usually do much less follow-ons in the beginning (especially initial seed funds). When VCs increase their fund size, the rationale is to have more capital for follow-ons. They also need to invest more in follow-ons to deploy that much capital. But as more dollars are invested in later-stage rounds, this increases the cost basis and effective post-money of the fund’s investment. This often drives down actual fund multiples, even if the investor doesn’t make a lot of mistakes by following-on into companies that ultimately fail. 4) The “pile in to your winners” strategy really only makes a big difference in two scenarios. The first is when the “winners” are really really big, meaning multiple billions of dollars. The second is when the pile-in happens relatively early. Usually, this happens because the company is under-appreciated. The investor leans in when others don’t believe and gets rewarded for it later. Apart from these situations, I think it’s somewhat questionable whether that strategy is worth the risk of piling into the wrong companies and the negative effect of increasing your overall cost basis. 5) This is why the very best VC firms do a combination of three things: Really focus on power-law outlier companies. Buy and maintain ownership cost effectively. Keep fund size to a reasonable level relative to their ownership targets. While the math may be simple, I think it’s very important for VCs, entrepreneurs, and journalists to understand how returns are actually calculated. It took me several years in VC to internalize these considerations and a few more to actually come to grips with its implications?—?but it’s dramatically changed the way I see the business and how we’ve shaped our fund strategy. About Scale Finance Scale Finance LLC (www.scalefinance.com) provides contract CFO services, Controller solutions, and support in raising capital, or executing M&A transactions, to entrepreneurial companies. The firm specializes in cost-effective financial reporting, budgeting & forecasting, implementing controls, complex modeling, business valuations, and other financial management, and provides strategic help for companies raising growth capital or considering M&A/recapitalization opportunities. Most of the firm’s clients are growing technology, healthcare, business services, consumer, and industrial companies at various stages of development from start-up to tens of millions in annual revenue. Scale Finance has multiple offices in the Carolinas including Charlotte, Raleigh/Durham, Greensboro, and Wilmington with a team of more than 45 professionals serving more than 130 companies throughout the region.

So you have finished reading the how much is 2x topic article, if you find this article useful, please share it. Thank you very much. See more: what does 2x return mean, what is 100x return, 2x growth meaning, how much is 100x in percentage, 1x profit meaning, how to calculate 10x in crypto, what is 2x 3x in crypto, 2x return on investment