당신은 주제를 찾고 있습니까 “macrofinancial history and the new business cycle facts – Macrofinancial History and the New Business Cycle Facts“? 다음 카테고리의 웹사이트 https://chewathai27.com/you 에서 귀하의 모든 질문에 답변해 드립니다: https://chewathai27.com/you/blog. 바로 아래에서 답을 찾을 수 있습니다. 작성자 NBER 이(가) 작성한 기사에는 조회수 59회 및 871412 Like 개의 좋아요가 있습니다.

macrofinancial history and the new business cycle facts 주제에 대한 동영상 보기

여기에서 이 주제에 대한 비디오를 시청하십시오. 주의 깊게 살펴보고 읽고 있는 내용에 대한 피드백을 제공하세요!

d여기에서 Macrofinancial History and the New Business Cycle Facts – macrofinancial history and the new business cycle facts 주제에 대한 세부정보를 참조하세요

Macrofinancial History and the New Business Cycle Facts

31st Annual Conference on Macroeconomics

https://www.nber.org/conferences/31st-annual-conference-macroeconomics-2016

Òscar Jordà, Federal Reserve Bank of San Francisco

April 15, 2016

macrofinancial history and the new business cycle facts 주제에 대한 자세한 내용은 여기를 참조하세요.

Macrofinancial History and the New Business Cycle Facts

Macrofinancial History and the New Business Cycle Facts. Oscar Jorda. Federal Reserve Bank of San Francisco. University of California, Davis.

Source: www.frbsf.org

Date Published: 3/1/2022

View: 2859

Macrofinancial History and the New Business Cycle Facts

What are the features of the modern business cycle? Output expansions have almost tripled after World War II, from 3.1 to 8.6 years, whereas credit expansions …

Source: www.journals.uchicago.edu

Date Published: 1/29/2022

View: 3994

Macrofinancial History and the New Business Cycle Facts

More financialized economies exhibit somewhat less real volatility, but also lower growth, more tail risk, as well as tighter real-real and real …

Source: www.nber.org

Date Published: 11/7/2021

View: 2347

Macrofinancial History and the New Business … – IDEAS/RePEc

Òscar Jordà & Moritz Schularick & Alan M. Taylor, 2017. “Macrofinancial History and the New Business Cycle Facts,” NBER Macroeconomics Annual, University of …

Source: ideas.repec.org

Date Published: 12/2/2022

View: 9258

Macrofinancial History and the New Business Cycle Facts

Specifically, they find that joint fluctuations in raw credit, credit-to-GDP and property prices are a strong predictor of financial crises.

Source: www.researchgate.net

Date Published: 1/22/2021

View: 9219

Macrofinancial history and the new business cycle facts – EconBiz

Macrofinancial history and the new business cycle facts. Oscar Jorda (Federal Reserve Bank of San Francisco, University of California, Davis), …

Source: www.econbiz.de

Date Published: 10/24/2022

View: 3385

Macrofinancial History and the New Business Cycle Facts

In advanced economies, a century-long near-stable ratio of credit to GDP gave way to rap financialization and surging leverage in the last …

Source: papers.ssrn.com

Date Published: 7/10/2021

View: 4976

Macrofinancial History and the New Business Cycle Facts

Access a free summary of Macrofinancial History and the New Business Cycle Facts, by Oscar Jorda et al. and 25000 other business, leadership and nonfiction …

Source: www.getabstract.com

Date Published: 10/24/2022

View: 3942

MACROFINANCIAL HISTORY AND THE NEW BUSINESS …

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor. 2018. “MACROFINANCIAL HISTORY AND THE NEW BUSINESS CYCLE FACTS.

Source: conferences.wcfia.harvard.edu

Date Published: 7/23/2021

View: 2764

주제와 관련된 이미지 macrofinancial history and the new business cycle facts

주제와 관련된 더 많은 사진을 참조하십시오 Macrofinancial History and the New Business Cycle Facts. 댓글에서 더 많은 관련 이미지를 보거나 필요한 경우 더 많은 관련 기사를 볼 수 있습니다.

주제에 대한 기사 평가 macrofinancial history and the new business cycle facts

- Author: NBER

- Views: 조회수 59회

- Likes: 871412 Like

- Date Published: 2022. 7. 15.

- Video Url link: https://www.youtube.com/watch?v=PO4k71eaeNY

What are the key business cycle facts?

A cycle consists of expansions occurring at about the same time in many economic activ- ities, followed by similarly general recessions, contractions and revivals which merge into the expansion phase of the next cycle; this sequence of changes is recur- rent but not periodic; in duration business cycles vary from more …

What is the historical cause of the business cycle?

The business cycle is caused by the forces of supply and demand—the movement of the gross domestic product GDP—the availability of capital, and expectations about the future. This cycle is generally separated into four distinct segments: expansion, peak, contraction, and trough.

What is the 4 business cycles and explain each?

business cycle, the series of changes in economic activity, has four stages—expansion, peak, contraction, and trough. Expansion is a period of economic growth: GDP increases, unemployment declines, and prices rise. The peak marks the end of an expansion and the beginning of the next stage, the contraction.

Who created the business cycle?

Business cycles as we know them today were first identified and analyzed by Arthur Burns and Wesley Mitchell in their 1946 book, Measuring Business Cycles. One of their key insights was that many economic indicators move together.

What are the five causes of business cycles?

- 1] Changes in Demand. Keynes economists believe that a change in demand causes a change in the economic activities. …

- Browse more Topics under Business Cycles. …

- 2] Fluctuations in Investments. …

- 3] Macroeconomic Policies. …

- 4] Supply of Money. …

- 1] Wars. …

- 2] Technology Shocks. …

- 3] Natural Factors.

What are the effects of business cycle?

Impact of business cycle on economy

A volatile business cycle is considered bad for the economy. A period of economic boom (rapid growth in GDP) invariably leads to inflation with various economic costs. This inflationary growth tends to be unsustainable and leads to a bust (recession).

Why is the business cycle important?

Understanding business cycles allows owners to make informed business decisions. By keeping a finger on the economy’s pulse and paying attention to current economic projections, they can speculate when to prepare for a contraction and take advantage of the expansion.

What business cycle are we currently in?

Key takeaways

The US and other major economies remain in the mid-cycle phase of the business cycle, but an increasing number of indicators suggest that the late cycle when economic growth slows may be approaching.

How long does a business cycle last?

The length of business cycles varies depending on the economy’s status. The average length of an expansion is a little under five years, and the average length of a contraction is 11 months. The average overall cycle length is 5-1/2 years.

What is the meaning of business cycle?

Business cycles are a type of fluctuation found in the aggregate economic activity of a nation — a cycle that consists of expansions occurring at about the same time in many economic activities, followed by similarly general contractions (recessions). This sequence of changes is recurrent but not periodic.

What is business cycle easy words?

A business cycle is the natural expansion and contraction of economic growth that happens in an economy over a period of time. The rise and fall of an economy’s gross domestic product (GDP) defines the start and end of a business cycle, which is also known as an economic cycle or a trade cycle.

What are the theories of business cycle?

Keynes has proposed three types of propensities to understand business cycles. These are propensity to save, propensity to consume, and propensity of marginal efficiency of capital. He has also developed a concept of multiplier that represents changes in income level produced by the changes in investment.

How many business cycles are there?

Key Takeaways

The business cycle goes through four major phases: expansion, peak, contraction, and trough.

What is the purpose of the business cycle?

The purpose of a business cycle is to track economic activity. In practical terms, the business cycle tracks the state of an economy from expansion to contraction and recession. It can affect how you spend, how you invest, and how you access credit.

What is a business cycle and why is it important?

The business cycle is a pattern of economic booms and busts exhibited by the modern economy. Business cycles are important because they can affect profitability, which ultimately determines whether a business succeeds.

What are the types of business cycle?

There are two types of business cycle: The classical cycle refers to rises and falls in total production. The growth cycle is concerned with fluctuations in the growth rate of production.

What are the phases of business cycle?

Throughout its life, a business cycle goes through four identifiable phases: expansion, peak, contraction, and trough.

Macrofinancial History and the New Business Cycle Facts: NBER Macroeconomics Annual: Vol 31

In advanced economies, a century-long, near-stable ratio of credit to GDP gave way to rapid financialization and surging leverage in the last forty years. This “financial hockey stick” coincides with shifts in foundational macroeconomic relationships beyond the widely noted return of macroeconomic fragility and crisis risk. Leverage is correlated with central business cycle moments, which we can document thanks to a decade-long international and historical data collection effort. More financialized economies exhibit somewhat less real volatility, but also lower growth, more tail risk, as well as tighter real-real and real-financial correlations. International real and financial cycles also cohere more strongly. The new stylized facts that we discover should prove fertile ground for the development of a new generation of macroeconomic models with a prominent role for financial factors.

“When you combine ignorance and leverage, you get some pretty interesting results.” —Warren Buffett

I. Introduction Observation is the first step of the scientific method. This paper lays empirical groundwork for macroeconomic models that take finance seriously. The global financial crisis reminded us that financial factors play an important role in shaping the business cycle, and there is growing agreement that new and more realistic models of real financial interactions are needed. Crafting such models has become one of the top challenges for macroeconomic research. Policymakers in particular seek a better understanding of the interaction between monetary, macroprudential, and fiscal policies. Our previous research (Schularick and Taylor 2012; Jordà, Schularick, and Taylor 2011, 2013, 2016a, 2016b) uncovered a key stylized fact of modern macroeconomic history that we may call the “financial hockey stick.” The ratio of aggregate private credit to income in advanced economies has surged to unprecedented levels over the second half of the twentieth century. A central aim of this paper is to show that, alongside this great leveraging, key business cycle moments have become increasingly correlated with financial variables. Most importantly, our long-run data provide evidence that high-credit economies may not be especially volatile, but their business cycles tend to be more negatively skewed. In other words, leverage is associated with dampened business cycle volatility, but more spectacular crashes. Business cycle outcomes become more asymmetric in high-credit economies, echoing previous research on the asymmetry of cycles (McKay and Reis 2008). A great deal of modern macroeconomic thought has relied on the small (and unrepresentative) sample of US post–World War II experience to formulate, calibrate, and test models of the business cycle; to calculate the welfare costs of fluctuations; and to analyze the benefits of stabilization policies. Yet the historical macroeconomic cross-country experience is richer. An important contribution of this paper is to introduce a new comprehensive macrofinancial historical database covering 17 advanced economies over the last 150 years.1 This considerable data-collection effort has occupied the better part of a decade and involved a small army of research assistants. We see two distinct advantages of using our data. First, models ostensibly based on universal economic mechanisms of the business cycle must account for patterns seen across space and time. Second, a very long-run perspective is necessary to capture enough “rare events” such as major financial dislocations and “macroeconomic disasters” to robustly analyze their impact on the volatility and persistence of real economic cycles. We begin by deconstructing the financial hockey stick. The central development of the second half of the twentieth century is the rise of household credit, mostly of mortgages. Business credit has increased as well, but at a slower pace. Home-ownership rates have climbed in almost every industrialized economy and, with them, real house prices. Private credit has increased much faster than income. Even though households are wealthier, private credit has grown faster even than the underlying wealth. Households are more levered than at any time in history. Next, we characterize the broad contours of the business cycle. Using a definition of turning points similar to many business cycle dating committees, such as the NBER’s, we investigate features of the business cycle against the backdrop of the financial cycle. The associations we present between credit and the length of the expansion, and between deleveraging and the speed of the recovery, already hint at the deeper issues requiring further analysis. Economies grow more slowly and generally more stably post–World War II. Despite this apparent stability, financial crises since the fall of Bretton Woods still occur with devastating regularity. These broad contours lead us to a reevaluation of conventional stylized facts on business cycles using our newer and more comprehensive data, with a particular emphasis on real financial interactions. The use of key statistical moments to describe business cycles goes back at least to the New Classical tradition that emerged in the 1970s (e.g., Kydland and Prescott 1990; Zarnowitz 1992; Backus and Kehoe 1992; Hodrick and Prescott 1997; Basu and Taylor 1999). Under this approach, the statistical properties of models are calibrated to match empirical moments in the data such as means, variances, correlations, and autocorrelations. In the final part of the paper, we examine key business cycle moments conditional on aggregate private-credit levels. We find that rates of growth, volatility, skewness, and tail events all seem to depend on the ratio of private credit to income. Moreover, key correlations and international cross correlations appear to also depend quite importantly on this leverage measure. Business cycle properties have changed with the financialization of economies, especially in the postwar upswing of the financial hockey stick. The manner in which macroeconomic aggregates correlate with each other has evolved as leverage has risen. Credit plays a critical role in understanding aggregate economic dynamics.

II. A New Data Set for Macrofinancial Research The data featured in this paper represent one of its main contributions. We have compiled, expanded, improved, and updated a long-run macrofinancial data set that covers 17 advanced economies since 1870 on an annual basis. The first version of the data set, unveiled in Jordà et al. (2011) and Schularick and Taylor (2012), covered core macroeconomic and financial variables for 14 countries. The latest vintage covers 17 countries and 25 real and nominal variables. Among these, there are time series that had been hitherto unavailable to researchers, especially for key financial variables such as bank credit to the nonfinancial private sector (aggregate and disaggregate) and asset prices (equities and housing). We have now brought together in one place macroeconomic data that previously had been dispersed across a variety of sources. This data set is publicly available at the NBER website. Table 1 gives a detailed overview of the coverage of the latest vintage of the data set, which gets updated on a regular basis as more data are unearthed and as time passes. More details about the data construction appear in an extensive 100-page online appendix, which also acknowledges the support we received from colleagues all over the world. Table 1. A New Macrofinancial Data Set (Available Samples Per Variable and Per Country) Country RGDPpc PPPGDPpc NGDP Population RCons. Inv. Curr. Acc. Exports Imports Gov. Exp. Gov. Rev. CPI Nrw. Mon. Australia 1870–2013 1870–2013 1870–2013 1870–2013 1901–2013 1870–1946 1870–2013 1870–1913 1870–1913 1902–2013 1902–2013 1870–2013 1870–2013 1949–2013 1915–2013 1915–2013 Belgium 1870–2013 1870–2013 1870–1913 1870–2013 1913–2013 1900–1913 1870–1913 1870–1913 1870–1913 1870–1912 1870–1912 1870–1914 1877–1913 1920–1939 1920–1939 1919–2013 1919–2013 1919–2013 1920–1939 1920–2013 1920–1939 1920–1940 1946–2013 1941 1941–2013 1945–2013 1947–2013 1943 1946–2013 Canada 1870–2013 1870–2013 1870–2013 1870–2013 1871–2013 1871–2013 1870–1945 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1871–2013 1948–2013 Switzerland 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–1913 1921–1939 1885–2013 1885–2013 1871–2013 1870–2013 1870–2013 1870–2013 1948–2013 1948–2013 Germany 1870–2013 1870–2013 1870–1944 1870–2013 1870–2013 1870–1913 1872–1913 1872–1913 1872–1913 1872–1913 1873–1915 1870–2013 1876–1913 1946–2013 1920–1939 1925–1938 1924–1943 1924–1943 1925–1938 1925–1938 1924–1938 1948–2013 1948–2013 1948–2013 1948–2013 1950–2013 1950–2013 1951–2011 Denmark 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–1914 1874–1914 1870–2013 1870–2013 1870–1935 1870–1935 1870–2013 1870–1945 1922–2013 1921–2013 1937–2013 1954–2013 1950–2013 Spain 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–1913 1870–1935 1870–1935 1870–1935 1870–1935 1880–2013 1874–1935 1931–1934 1939–2013 1939–2013 1940–2013 1940–2013 1941–2011 1940–2013 Finland 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1882–2013 1882–2013 1870–2013 1870–2013 France 1870–2013 1870–2013 1870–1913 1870–2013 1870–2013 1870–1918 1870–1913 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–1913 1920–1938 1920–1944 1919–1939 1920–2013 1950–2013 1946–2013 1948–2013 UK 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 Italy 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 Japan 1870–2013 1870–2013 1875–1944 1870–2013 1874–2013 1885–1944 1870–1944 1870–1943 1870–1943 1870–2013 1870–2013 1870–2013 1873–2013 1946–2013 1946–2013 1946–2013 1946–2013 1946–2013 Netherlands 1870–2013 1870–2013 1870–1913 1870–2013 1870–2013 1870–1913 1870–1913 1870–1943 1870–1943 1870–2013 1870–2013 1870–2013 1870–1941 1921–1939 1921–1939 1921–1939 1946–2013 1946–2013 1945–2013 1945–2013 1948–2013 1948–2013 Norway 1870–2013 1870–2013 1870–1939 1870–2013 1870–2013 1870–1939 1870–1939 1870–2013 1870–2013 1870–2013 1870–1943 1870–2013 1870–2013 1946–2013 1946–2013 1946–2013 1949–2013 Portugal 1870–2013 1870–2013 1870–2013 1870–2013 1910–2013 1953–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 Sweden 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1871–2013 USA 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 Country Broad Mon. S.t. Rate L.t. Rate Stocks Ex. Rate Pub. Debt Bank Lend. Mort. Lend. Hh. Lend. Bus. Lend. H. Prices Bk. Crisis Australia 1870–2013 1870–1944 1870–2013 1870–2013 1870–2013 1870–2013 1870–1945 1870–1945 1870–1945 1870–1945 1870–2013 1870–2013 1948–2013 1948–2013 1952–2013 1952–2013 1952–2013 Belgium 1979–2013 1870–1914 1870–1912 1870–2013 1870–2013 1870–1913 1885–1913 1885–1913 1950–2013 1950–2013 1878–1913 1870–2013 1920–2013 1920–2013 1920–1939 1920–1940 1920–1939 1919–2013 1946–1979 1950–2013 1950–2013 1982–2013 Canada 1871–2013 1934–1944 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1874–2013 1956–2013 1961–2013 1921–1949 1870–2013 1948–2013 1956–2013 Switzerland 1880–2013 1870–2013 1880–2013 1899–1914 1870–2013 1880–2013 1870–2013 1870–2013 1870–2013 1870–2013 1901–2013 1870–2013 1916–2013 Germany 1880–1913 1870–1914 1870–1921 1870–1921 1870–1944 1871–1913 1883–1920 1883–1919 1950–2013 1950–2013 1870–1922 1870–2013 1925–1938 1919–1922 1924–1943 1924–2013 1946–2013 1927–1943 1924–1940 1924–1940 1924–1938 1924–1944 1948–2013 1950–2013 1946–2013 1949–2013 1962–2013 1949–2013 1950–2013 Denmark 1870–1945 1875–2013 1870–2013 1892–2013 1870–2013 1880–1946 1870–2013 1875–2013 1951–2013 1951–2013 1875–2013 1870–2013 1950–2013 1953–1956 1960–1996 1998–2013 Spain 1874–1935 1883–1914 1870–1936 1870–2013 1870–2013 1880–1935 1900–1935 1904–1935 1946–2013 1946–2013 1971–2013 1870–2013 1941–2013 1920–2013 1940–2013 1940–2013 1946–2013 1946–2013 Finland 1870–2013 1870–2013 1870–1938 1912–2013 1870–2013 1914–2013 1870–2013 1927–2013 1948–2013 1948–2013 1905–2013 1870–2013 1948–2013 France 1870–1913 1870–1914 1870–2013 1870–2013 1870–2013 1880–1913 1900–1938 1870–1933 1958–2013 1958–2013 1870–2013 1870–2013 1920–2013 1922–2013 1920–1938 1946–2013 1946–2013 1949–2013 UK 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1880–2013 1880–2013 1880–2013 1880–2013 1899–1938 1870–2013 1946–2012 Italy 1880–2013 1885–1914 1870–2013 1906–2013 1870–2013 1870–2013 1870–2013 1870–2013 1950–2013 1950–2013 1870–2013 1870–2013 1922–2013 Japan 1894–2013 1879–1938 1870–2013 1878–1891 1870 1875–1944 1874–2013 1893–1940 1948–2013 1948–2013 1913–1930 1870–2013 1957–2013 1893–2013 1873–2013 1946–2013 1946–2013 1936–2013 Netherlands 1870–1941 1870–1914 1870–2013 1890–1944 1870–2013 1870–1939 1900–2013 1900–2013 1990–2013 1990–2013 1870–2013 1870–2013 1945–2013 1919–1944 1946–2013 1946–2013 1948–2013 Norway 1870–2013 1870–1965 1870–2013 1914–2013 1870–2013 1880–1939 1870–2013 1870–2013 1978–2013 1978–2013 1870–2013 1870–2013 1967–2013 1947–2013 Portugal 1913–2013 1880–2013 1870–2013 1929–2013 1870–2013 1870–2013 1870–1903 1920–2013 1979–2013 1979–2013 1988–2013 1870–2013 1920–2013 Sweden 1871–2013 1870–2013 1870–2013 1870–2013 1870–2013 1870–2013 1871–2013 1871–2013 1871–1940 1975–2013 1875–2013 1870–2013 1975–2013 USA 1870–2013 1870–2013 1870–2013 1871–2013 1870–2013 1870–2013 1880–2013 1880–2013 1945–2013 1945–2013 1890–2013 1870–2013 In addition to country experts, we consulted a broad range of sources such as economic and financial history volumes and journal articles, and various publications of statistical offices and central banks. For some countries we extended existing data series from previous statistical work of financial historians or statistical offices. This was the case for Australia, Canada, Japan, and the United States. For other countries we chiefly relied on recent data collection efforts at central banks such as for Denmark, Italy, and Norway. Yet in a non-negligible number of cases we had to go back to archival sources including documents from governments, central banks, and private banks. Typically, we combined information from various sources and spliced series to create long-run data sets spanning the entire 1870–2014 period for the first time.

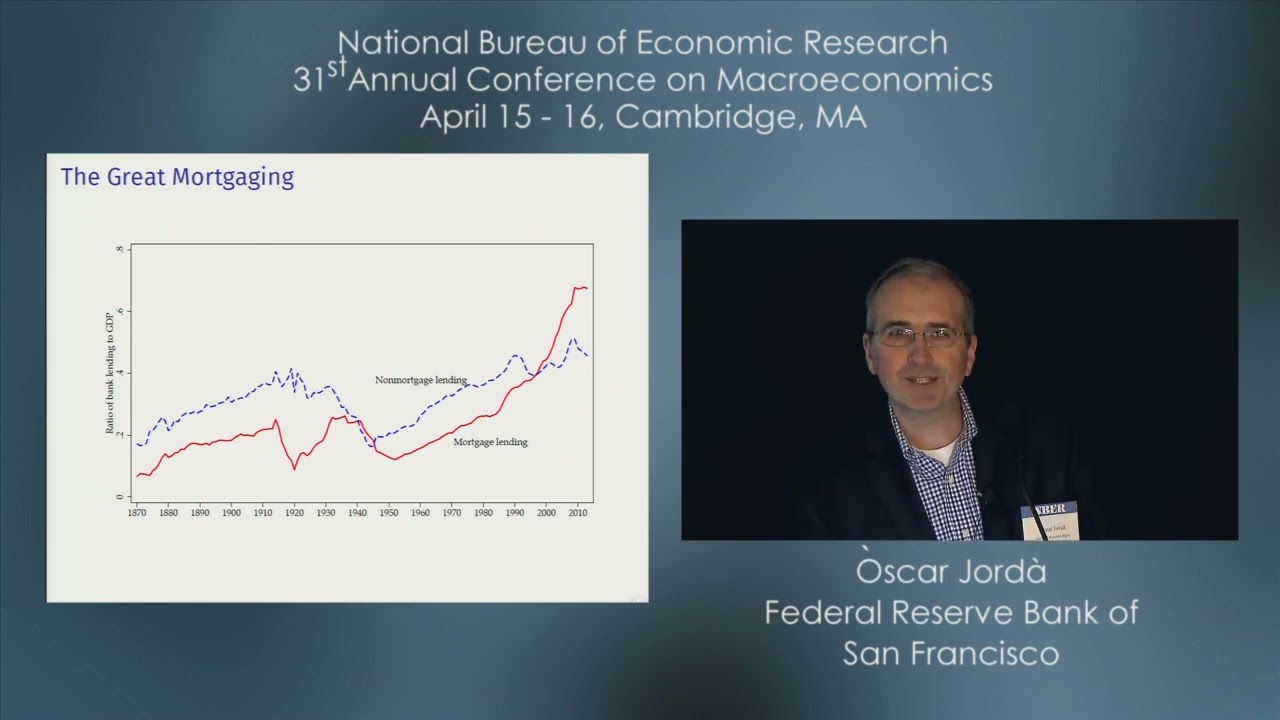

III. The Financial Hockey Stick The pivotal feature to emerge in the last 150 years of global macroeconomic history, as was first highlighted in Schularick and Taylor (2012), is the “hockey stick” pattern of private credit in advanced economies displayed in figure 1. Focusing on private credit, defined henceforth as bank lending to the nonfinancial private sector, we can see that this variable maintained a relatively stable relationship with gross domestic product (GDP) and broad money until the 1970s. After an initial period of financial deepening in the nineteenth century, the average level of the credit-to-GDP ratio in advanced economies reached about 50%–60% around 1900. With the exception of the deep contraction in bank lending that was seen from the crisis of the Great Depression to World War II, the ratio was stable in this range until the 1970s. Fig. 1. The financial hockey stick Note: Total loans is bank lending to the nonfinancial private sector, broad money is M2 or similar broad measure of money, both expressed as a ratio to GDP averaged over the 17 countries in the sample (see text). Throughout this chapter we use the term “leverage” to denote the ratio of private credit to GDP. Although leverage is often used to designate the ratio of credit to the value of the underlying asset or net worth, income leverage is equally important, as debt is serviced out of income. Net-worth-leverage is more unstable due to fluctuations in asset prices. For example, at the peak of the recent US housing boom, ratios of debt to housing wealth signaled that household leverage was declining just as ratios of debt to income were exploding (Foote, Gerardi, and Willen 2012). Similarly, corporate balance sheets based on market values may mislead: in 2006–07 overheated asset values indicated robust capital ratios in major banks that were in distress or outright failure a few months later. In the past four decades, the volume of private credit has grown dramatically relative to both output and monetary aggregates, as shown in figure 1. The disconnect between private credit and (traditionally measured) monetary aggregates has resulted, in large part, from the shrinkage of bank reserves and the increasing reliance by financial institutions on nonmonetary means of financing, such as bond issuance and interbank lending. Private credit in advanced economies doubled relative to GDP between 1980 and 2009, increasing from 62% in 1980 to 118% in 2010. The data also demonstrate the breathtaking surge of bank credit prior to the global financial crisis in 2008. In a little more than 10 years, between the mid-1990s and 2008–09, the average bank credit-to-GDP ratio in advanced economies rose from a little under 80% of GDP in 1995 to more than 110% of GDP in 2007. This 30 percentage points (pps) increase is likely to be a lower bound estimate as credit creation by the shadow banking system, of considerable size in the United States and to a lesser degree in the United Kingdom, is excluded from our banking-sector data. What has been driving this great leveraging? A look at the disaggregated credit data, discussed in greater detail in Jordà, Schularick, and Taylor (2015), shows that the business of banking evolved substantially over the past 140 years. Figure 2 tracks the development of bank lending to the nonfinancial corporate sector and lending to households for our sample of 17 advanced economies. The ratio of business lending relative to GDP has remained relatively stable over the past century. On the eve of the global financial crisis, bank credit to corporates was not meaningfully higher than on the eve of World War I. Fig. 2. Bank lending to business and households Note: Business loans and household loans are expressed as a ratio to GDP averaged over the 17 countries in the sample (see text). Figure 3 tracks the evolution of mortgage and nonmortgage lending (mostly unsecured lending to businesses) relative to GDP from 1870 to the present. The graph demonstrates that mortgage borrowing has accelerated markedly in the advanced economies after World War II, a trend that is common to almost all individual economies. Mortgage lending to households accounts for the lion’s share of the rise in credit-to-GDP ratios in advanced economies since 1980. To put numbers on these trends: at the turn of the nineteenth century, mortgage credit accounted for less than 20% of GDP on average. By 2010, mortgage lending represented 70% of GDP, more than three times the historical level at the beginning of the twentieth century. The main business of banks in the early 1900s consisted of making unsecured corporate loans. Today, however, the main business of banks is to extend mortgage credit, often financed with short-term borrowings. Mortgage loans now account for somewhere between one-half and two-thirds of the balance sheet of a typical advanced-country bank. Fig. 3. The great mortgaging Note: Mortgage loans and nonmortgage loans are expressed as a ratio to GDP averaged over the 17 countries in the sample. Mortgage lending is to households and firms. Nonmortgage lending is unsecured lending primarily to businesses (see text). It is true that a substantial share of mortgage lending in the nineteenth century bypassed the banking system and took the form of private lending. Privately held mortgage debt likely accounted for close to 10% of GDP at the beginning of the twentieth century. A high share of farm and nonfarm mortgages was held outside banks in the United States and Germany (Hoffman, Postel-Vinay, and Rosenthal 2000). A key development in the twentieth century was the subsequent transition of these earlier forms of “informal” real estate finance into the hands of banks and the banking system in the course of the twentieth century. Moreover, even as we discuss the key aggregate trends, we do not mean to downplay the considerable cross-country heterogeneity in the data. Table 2 decomposes for each country the increase of total bank lending to GDP ratios over the past 50 years into growth of household debt and business debt as well as secured and unsecured lending. The percentage point change in the ratio of private credit to GDP in Spain was about three times higher than in Japan and more than twice as high as in Germany and Switzerland. However, it is equally clear from the table that the increase in the private credit-to-GDP ratio, as well as the central role played by mortgage credit to households, are both widespread phenomena. Table 2. Change in Bank Lending-to-GDP Ratios (Multiple), 1960–2012 Country Total Lending

(1) Mortgage

(2) Nonmortgage

(3) Households

(4) Business

(5) Netherlands 1.31 0.67 0.63 — — Denmark 1.18 0.98 0.19 0.75 0.43 Australia 1.12 0.72 0.40 0.78 0.34 Spain 1.11 0.78 0.33 0.70 0.41 Portugal 1.01 0.59 0.42 — — USA* 0.82 0.43 0.39 0.40 0.42 USA 0.21 0.17 0.04 0.13 0.07 Sweden 0.76 0.48 0.29 — — Great Britain 0.73 0.51 0.23 0.61 0.12 Canada 0.69 0.39 0.30 0.60 — Finland 0.62 0.27 0.35 0.42 0.19 Switzerland 0.61 0.83 −0.21 0.60 0.01 Italy 0.55 0.49 0.07 0.39 0.16 France 0.54 0.41 0.12 0.41 0.13 Belgium 0.51 0.32 0.19 0.34 0.17 Germany 0.49 0.28 0.21 0.20 0.29 Norway 0.40 0.53 −0.13 — — Japan 0.38 0.41 −0.03 0.28 0.10 Average 0.72 0.52 0.20 0.48 0.20 Fraction of Average 1.00 0.72 0.28 0.71 0.29 The central question that we address in the remainder of the paper is to see if and how this secular growth of finance, the growing leverage of incomes, and the changes in the composition of bank lending have gone hand in hand with changes in the behavior of macroeconomic aggregates over the business cycle.

IV. Household Leverage, Home Ownership, and House Prices A natural question to ask is whether this surge in household borrowing occurred on the intensive or extensive margin. In other words, did more households borrow or did households borrow more? Ideally, we would have long-run household-level data to address this question, but absent such figures we can nonetheless infer some broad trends from our data. If households increased debt levels, not only relative to income but also relative to asset values, this would raise greater concerns about the macroeconomic stability risks stemming from more highly leveraged household portfolios. Historical data for the total value of the residential housing stock (structures and land) are only available for a number of benchmark years. We relate those to the total volume of outstanding mortgage debt to get an idea about long-run trends in real estate leverage ratios. Regarding sources, we combine data from Goldsmith’s (1985) classic study of national balance sheets with recent estimates of wealth-to-income ratios by Piketty and Zucman (2013). Margins of error are wide, as it is generally difficult to separate the value of residential land from overall land for the historical period. We had to make various assumptions on the basis of available data for certain years. Figure 4 shows that the ratio of household mortgage debt to the value of real estate has increased considerably in the United States and the United Kingdom in the past three decades. In the United States, mortgage debt-to-housing value climbed from 28% in 1980 to over 40% in 2013, and in the United Kingdom from slightly more than 10% to 28%. A general upward trend in the second half of the twentieth century is also clearly discernible in a number of other countries. Fig. 4. Ratio of household mortgage lending to the value of the housing stock Figure 5 shows that this upward trend in debt-to-asset ratios coincided with a surge in global house prices, as discussed in Knoll, Schularick, and Steger (2015). Real house prices exhibit a hockey-stick pattern just like the credit aggregates. Having stayed constant for the first century of modern economic growth, global house prices embarked on a steep ascent in the second half of the twentieth century and tripled within three decades of the onset of large-scale financial liberalization. Fig. 5. Real house prices, 1870–2013 Source: Knoll, Schularick, and Steger (2015). Note: Average CPI-deflated house price index for 14 advanced countries. A second trend is equally important: the extensive margin of mortgage borrowing also played a role. Table 3 demonstrates that the rise in economy-wide leverage has financed a substantial expansion of home ownership in many countries. The idea that home ownership is an intrinsic part of the national identity is widely accepted in many countries, but in most cases it is a relatively recent phenomenon. Before World War II, home ownership was not widespread. In the United Kingdom, for instance, home-ownership rates were in the low 20% range in the 1920s. In the United States, the home-ownership rate did not cross the 50% bar until after World War II, when generous provisions in the GI Bill helped push it up by about 10 percentage points. For the sample average, home-ownership rates were around 40% after World War II. By the first decade of the twenty-first century, they had risen to 60%—an increase of about 20 percentage points in the course of the past half century. In some countries, such as Italy, we observe that home-ownership rates doubled after World War II. In others, such as France and the United Kingdom, they went up by nearly 50%. Table 3. Home-Ownership Rates in the Twentieth Century (Owner-Occupied Share of Units, Percent) Canada Germany France Italy Switzerland United Kingdom United States Average 1900 47 1910 46 1920 23 46 1930 48 1940 57 32 44 1950 66 39 38 40 37 32 47 43 1960 66 34 41 45 34 42 62 46 1970 60 36 45 50 29 50 63 48 1980 63 39 47 59 30 58 64 51 1990 63 39 55 67 31 68 64 55 2000 66 45 56 80 35 69 67 60 2013 69 45 58 82 37 64 65 60 Quantitative evidence on the causes of such pronounced differences in home-ownership rates between advanced economies is still scarce. Differences in rental regulation, tax policies, and other forms of government involvement, as well as ease of access to mortgage finance and historical path dependencies, likely all played a role. Studies in historical sociology, such as Kohl (2014), explain differences in home-ownership rates between the United States, Germany, and France, as a consequence of the dominant role played by the organization of urban housing markets. In all countries, the share of owner-occupied housing is roughly comparable in rural areas; rather, the stark differences in aggregate ownership rates are mainly a function of the differences in the organization of urban housing across countries. Divergent trajectories in housing policy also matter. In the United States, the Great Depression was the main catalyst for new policies aimed at facilitating home ownership. Yet government interventions in the housing market remained an important part of the policy landscape after World War II, or even intensified. In the US case, the Veterans Administration (VA) was established through the GI Bill in 1944. The VA guaranteed loans with high loan-to-value ratios over 90%, with some loans passing the 100% loan-to-value mark (Fetter 2013). Forty percent of all mortgages were federally subsidized in the 1950s. The GI Bill is credited with explaining up to one-quarter of the post–World War II increase in the rate of home ownership. In many European countries, the government already took a more active role in the housing sector following World War I. But European housing policies tended to focus on public construction and ownership of housing, whereas in the United States, the emphasis was on financial support for individual home ownership through the subsidization of mortgage interest rates or public loan guarantees. The experience with the Great Depression was also formative with regard to the growing role of the state in regulating and ultimately backstopping the financial sector. The most prominent innovation was deposit insurance. In the United States, deposit insurance was introduced as part of the comprehensive Banking Act of 1933, commonly known as the Glass-Steagall Act. Some European countries like Switzerland and Belgium also introduced deposit insurance schemes in the 1930s. In the majority of European countries deposit insurance was introduced in the decades following World War II, albeit with considerable institutional variety (Demirgüç-Kunt, Kane, and Laeven 2013). However, different American and European approaches to the organization of deposit insurance are observable. This is because, at least in the early stages, European deposit insurance schemes relied chiefly on industry arrangements. The United States stands out as the first country that committed the tax payer to back-stopping the banking system. A common effect of the Depression, however, was that in almost all countries the role of the state as a financial player increased. After the devastating consequences of a dysfunctional financial sector had become apparent during the 1930s, the sector was kept on a short leash. Directly or indirectly, the state became more intertwined with finance. Among the major economies, Germany clearly went to one extreme by turning the financial sector into little more than a handmaiden of larger policy goals in the 1930s. In doing so, it inadvertently pioneered various instruments of financial repression (e.g., channeling deposits into government debt) that, in one form or the other, became part of the European financial policy tool kit after World War II. For instance, France ran a tight system of controls on savings flows in the postwar decades (Monnet 2014). In this long-run context, can we say in any quantitative way the role played by debt-income and debt-wealth changes over time in the evolution of leverage? To this end, figure 6 and Table 4 provide comparisons of borrowing, wealth, and GDP. The figure displays three grand ratios for the average of the United States, United Kingdom, France, and Germany over the post–World War II era in 20-year windows. Panel (a) displays total private lending to the nonfinancial sector (total lending) as a ratio to GDP (solid line), total lending as a ratio to total wealth (dashed line), and total wealth as a ratio to GDP (dotted line). Panel (b) of the same figure presents a similar but more granular decomposition to focus on the housing market: the ratio of mortgages to GDP (solid thick line), the ratio of mortgages to housing wealth (dashed line), and the ratio of housing wealth to GDP (dotted line). Data on wealth come from Piketty and Zucman (2013) and are available only for selected countries and a limited sample. Fig. 6. Leverage—loans, wealth, and income in the United States, United Kingdom, France, and Germany, averages Source: Data on wealth and housing wealth available online at http:piketty.pse.ens.fr/en/capitalisback from Piketty and Zucman (2013). All other data collected by the authors. Note: Variables expressed as ratios. Right-hand-side axes always refer to wealth over GDP ratios. Table 4. Leverage—Grand Ratios for Loans, Wealth, and GDP in the United States, United Kingdom, France, and Germany (Averages and by Country) (a) All Wealth, All Loans (b) Housing Wealth, Mortgage Loans 1950 1970 1990 2010 1950 1970 1990 2010 Loans/GDP US 0.55 0.90 1.2 1.65 0.30 0.44 0.63 0.92 UK 0.23 0.30 0.88 1.07 0.09 0.15 0.38 0.65 France 0.32 0.59 0.79 0.98 0.10 0.19 0.30 0.52 Germany 0.19 0.59 0.87 0.95 0.03 0.25 0.27 0.46 Average 0.32 0.59 0.94 1.16 0.13 0.26 0.40 0.64 Loans/Wealth US 0.14 0.23 0.29 0.38 0.18 0.26 0.35 0.47 UK 0.11 0.09 0.19 0.20 0.08 0.11 0.19 0.21 France 0.11 0.16 0.21 0.16 0.08 0.12 0.16 0.13 Germany 0.08 0.19 0.24 0.23 0.04 0.17 0.14 0.19 Average 0.11 0.17 0.24 0.24 0.09 0.16 0.21 0.25 Wealth/GDP US 3.80 4.00 4.19 4.31 1.70 1.71 1.83 1.94 UK 2.08 3.33 4.62 5.23 1.11 1.44 1.99 3.03 France 2.91 3.63 3.68 6.05 1.30 1.64 1.94 3.83 Germany 2.29 3.13 3.55 4.14 0.91 1.48 1.91 2.39 Average 2.77 3.52 4.01 4.93 1.26 1.57 1.92 2.80 Similarly, table 4 displays these three grand ratios, again organized by the same principles: panel (a), for all categories of lending and wealth; panel (b), for mortgages and housing wealth. The table provides data for the United States, United Kingdom, France, and Germany, as well as the average across all four, which is used to construct figure 6. It should be clear from the definition of these three grand ratios that our concept of leverage, defined as the ratio of lending to GDP, is mechanically linked to the ratio of lending to wealth times the ratio of wealth to GDP. Figure 6 and panel (b) of Table 4, in particular, give a compelling reason to focus on the ratio of mortgages to GDP rather than as a ratio to housing wealth. In the span of the last 60 years, the ratio of mortgages to GDP is nearly six times larger; whereas, measured against housing wealth, mortgages have almost tripled. Of course, the reason for this divergence is the accumulation of housing wealth over the this period, which has more than doubled when measured against GDP. Summing up, our study of the financial hockey stick has yielded three core insights. First, the sharp rise of aggregate credit-to-income ratios is linked mainly to rising mortgage borrowing by households. Bank lending to the business sector has played a subsidiary role in this process and has remained roughly constant relative to income. Second, the rise in aggregate mortgage borrowing relative to income has been driven by substantially higher aggregate loan-to-value ratios against the backdrop of house price gains that have outpaced income growth in the final decades of the twentieth century. Lastly, the extensive margin of increasing home-ownership rates mattered, too. In many countries, home-ownership rates have increased considerably. The financial hockey stick can therefore be understood as a corollary of more highly leveraged home ownership against substantially higher asset prices.

V. Expansions, Recessions, and Credit What are the key features of business and financial cycles in advanced economies over the last 150 years? A natural way to tackle this question is to divide our annual frequency sample into periods of real GDP per capita growth or expansions, and years of real GDP per capita decline or recessions. At annual frequency, this classification is roughly equivalent to the dating of peaks and troughs routinely issued by business cycle committees, such as the NBER’s for the United States. We will use the same approach to discuss cycles based on real credit per capita (measured by our private credit variable deflated with the CPI index). This will allow us to contrast the GDP and credit cycles. This characterization of the cycle does not depend on the method chosen to detrend the data, or on how potential output and its dynamics are determined. Rather, it is based on the observation that in economies where the capital stock and population are growing, negative economic growth represents a sharp deterioration in business activity, well beyond the vagaries of random noise.2 In a recent paper, McKay and Reis (2008) reach back to Mitchell (1927) to discuss two features of the business cycle, “brevity” and “violence,” in Mitchell’s words.3 Harding and Pagan (2002) provide more operational definitions that are roughly equivalent. In their paper, brevity refers to the duration of a cyclical phase, expressed in years. Violence refers to the average rate of change per year. It is calculated as the overall change during a cyclical phase divided by its duration and expressed as percent change per year. These simple statistics, duration (or violence) and rate (or brevity), can be used to summarize the main features of business and credit cycles. Table 5 shows two empirical regularities: (1) the growth cycles in real GDP (per capita) and in real credit growth using turning points in GDP; and (2) the same comparison between GDP and credit, this time using turning points in credit. In both cases, the statistics are reported as an average for the full sample of 17 advanced economies, and for the pre– and post–World War II subsamples. Table 5. Duration and Rate of Change—GDP versus Credit Cycles Expansions Recessions Full Pre-WWII Post-WWII Full Pre-WWII Post-WWII GDP-based cycles Duration (years) 5.1 3.1 8.6 1.5 1.6 1.4 (5.5) (2.7) (7.2) (0.9) (1.0) (0.8) Rate (% p.a) GDP 3.7 4.1 3.0 −2.5 −2.9 −1.7) (2.3) (2.5) (1.7) (2.5) (2.8) (1.5) Credit 4.6 4.7 4.5 2.2 3.7 0.0 (10) (13) (4.3) (8.0) (8.9) (5.7) P-value H 0 : GDP = credit 0.10 0.46 0.00 0.00 0.00 0.00 Observations 315 203 112 323 209 114 Credit-based cycles Duration (years) 6.1 4.2 8.3 1.9 1.7 2.0 (6.4) (4.3) (7.6) (1.5) (1.5) (1.5) Rate (% p.a) 2.1 1.6 2.8 1.2 1.5 0.8 GDP (3.1) (3.7) (2.0) (3.3) (3.8) (2.4) Credit 7.0 7.9 5.9 −5.0 −6.5 −3.3 (5.6) (6.8) (3.5) (6.7) (8.4) (3.1) P-value H 0 : GDP =credit 0.00 0.00 0.00 0.00 0.00 0.00 Observations 240 130 110 254 141 113 What are the features of the modern business cycle? Output expansions have almost tripled after World War II, from 3.1 to 8.6 years, whereas credit expansions have roughly doubled, from 4.2 to 8.3 years. On the other hand, recessions tend to be briefer and roughly similar before and after World War II. Moreover, there is little difference (certainly no statistically significant difference) between the duration of output and credit-based recessions. The elongation of output expansions after World War II coincides with a reduction in the rate of growth, from 4.1 to 3.0% per annum (p.a.), accompanied with a reduction in volatility. Expansions are more gradual and less volatile. A similar phenomenon is visible in recessions, where the rate of decline essentially halves from 2.9% p.a. pre–World War II to 1.7% p.a. post–World War II. Interestingly, the behavior of credit is very similar across eras, but only during expansions. The rate of credit growth is remarkably stable through the entire period, from 4.7% pre–World War II to 4.5% post–World War II. Credit seems to grow on a par with output before World War II (the null cannot be rejected formally with a p-value of 0.46), whereas it grows nearly 1.5 percentage points faster than output post–World War II, a statistically significant difference (with a p-value below 0.01). In recessions, credit growth continues almost unabated in the pre–World War II era (it declines from 4.7% p.a. in expansion to 3.7% p.a. in recession) but it grinds to a halt post–World War II (from 4.5% p.a. in expansion to 0% p.a. in recession). Credit cycles do not exactly align with business cycles. This can be seen via the concordance index, defined as the average fraction of the time two variables spend in the same cyclical phase. This index equals 1 when cycles from both variables exactly match, that is, both are in expansion and in recession at a given time. The index is 0 if one of the variables is in expansion and the other is in recession, or vice versa. Using this definition, before World War II the concordance index is 0.61, suggesting a weak link between output and credit cycles. If output is in expansion, it is almost a coin toss whether credit is in expansion or in recession. However, post–World War II the concordance index rises to 0.79. This value is similar, for example, to the concordance index between output and investment cycles post–World War II. Another way to see the increased synchronization between output and credit cycles is made clear in the bottom panel of Table 5. The duration of credit expansions is about one year longer than the duration of GDP expansions pre–World War II, but roughly the same length post–World War II. Credit recessions are slightly longer than GDP recessions (by about three months, on average), but not dramatically different. Thus both types of cycle exhibit considerable asymmetry in duration between expansion and recession phases. As we can also see in Table 5, things are quite different when considering the average rate of growth during each expansion/recession phase. Whereas credit grew in expansion at nearly 8% p.a. pre–World War II, output grew at only 1.6% p.a. After World War II, the tables are turned. Credit grows 2 percentage points slower, but output grows almost twice as fast. On average, there is a much tighter connection between growth in the economy and growth in credit after World War II. Perhaps the more obvious takeaway is that credit turns out to be a more violent variable than GDP. Credit expansions and recessions exhibit wilder swings than GDP expansions and recessions. These results raise some intriguing questions. What is behind the longer duration of expansions since World War II? What connection, if any, does this phenomenon have to do with credit? In previous research (Jordà et al. 2013), we showed that rapid growth of credit in the expansion is usually associated with deeper and longer-lasting recessions, everything else equal. But what about the opposite? Does rapid deleveraging in the recession lead to faster and brighter recoveries? And what is the relationship between credit in the expansion and its duration? Does more rapid deleveraging make the recession last longer? In order to answer some of these questions, we stratify the results by credit growth in the next two tables. In Table 6 we stratify results depending on whether credit in the current expansion is above or below country-specific means and examine how this correlates with the current expansion and subsequent recession. Consistent with the results reported in our previous work (Jordà et al. 2013), rapid credit growth during the expansion is associated with a deeper recession, especially in the post–World War II era. Compare here rates of decline per annum, –1.8% versus –1.6% with the recession lasting about five months more. However, it is also true that the expansion itself lasts about three years longer (and at a higher per annum rate of growth). Pre–World War II, expansions last about nine months longer when credit grows above average, and there is little difference in the brevity of recessions. Table 6. Duration and Rate of Real GDP Cycles—Stratified by Credit Growth in Current Expansion Current Expansion Subsequent Recession Full Sample Pre-WWII Post-WWII Full Sample Pre-WWII Post-WWII Duration (years) High credit 6.3 3.4 10.2 1.6 1.5 1.7 Expansion (6.5) (3.2) (7.1) (0.9) (0.8) (0.9) Low credit 3.8 2.6 7.0 1.5 1.6 1.3 Expansion (3.6) (1.9) (6.6) (0.8) (1.0) (0.5) rate (% p.a.) High credit 3.3 3.8 3.0 −2.4 −3.0 −1.8 Expansion (2.0) (2.3) (1.5) (2.3) (2.8) (1.3) Low credit 4.1 4.7 2.7 −2.7 −3.3 −1.6 Expansion (2.5) (2.7) (1.4) (2.8) (3.2) (1.7) Observations 271 164 107 261 153 108 The shaft and the blade of our financial hockey stick thus also appear to mark a shift in the manner in which credit and the economy interact. Since World War II, rapid credit growth is associated with longer-lasting expansions (by about three years) and more rapid rates of growth (3.0% versus 2.7%). However, when the recession hits, the economic slowdown is also deeper. In terms of a crude trade-off, periods with above mean credit growth are associated with an additional 12% growth in output relative to a 1% loss during the following recession, a net gain of nearly 11% over the 12 years that the entire cycle lasts (expansion plus recession), that is, almost an extra 1% per year. As a complement to these results, Table 7 provides a similar stratification based on whether credit grows above or below country-specific means during the current recession, and then examines the current recession and the subsequent expansion. A high credit bin here means that credit grew above average during the recession (or that there was less deleveraging, in some cases). The low credit bin is associated with recessions in which credit grew below average or there was more deleveraging, in some cases. Table 7. Duration and Rate of Real GDP Cycles—Stratified by Credit Growth in Current Recession Current Expansion Subsequent Recession Full Sample Pre-WWII Post-WWII Full Sample Pre-WWII Post-WWII Duration (years) High credit 1.5 1.5 1.3 3.9 2.8 6.4 Recession (0.9) (0.9) (.5) (3.7) (2.3) (4.9) Low credit 1.6 1.7 1.6 6.1 3.2 10.2 Recession (0.9) (1.0) (0.9) (6.4) (2.9) (8.2) Rate (% p.a.) High credit −3.2 −4.0 −1.9 4 4.8 2.7 Recession (3.0) (3.3) (1.7) (2.5) (2.8) (1.3) Low credit −1.9 −2.3 −1.4 3.4 3.8 2.9 Recession (1.7) (2.1) (1.2) (2.1) (2.4) (1.4) Observations 287 173 114 269 165 104 On a first pass, for the post–World War II era only, low credit growth in a recession is associated with a slightly deeper recession (less violent, but longer lasting, for a total loss in output of 2.5% versus 2.25%), but with a more robust expansion thereafter (about 12% more in cumulative terms over the subsequent expansion, with the expansion lasting about four years longer). There does not seem to be as marked an effect pre–World War II. Tables 6 and 7 reveal an interesting juxtaposition: in the post–World War II era, whereas rapid credit growth in the expansion is associated with a longer expansion, a deeper recession but an overall net gain, it is below average credit growth in the recession that results in more growth in the expansion even at a small cost of a deeper recession in the short term. It is natural to ask then the extent to which high credit growth cycles follow each other. Is rapid growth in the expansion followed by a quick deceleration in the recession? Or is there no relation? To answer these questions, one can calculate the state-transition probability matrix relating each type of cycle binned by above or below credit growth. This transition probability matrix is reported in table A1 in the appendix. Table A1 suggests that knowing whether the state of the preceding expansion was in the high credit or low credit bins has little predictive power about the state in the current recession or the expansion that follows (the transition probabilities across all possible states are almost all 0.5). The type of recession also appears to have little influence on the type of expansion the economy is likely to experience. However, in the post–World War II era we do find that a low credit recession is slightly more likely (p = 0.62) to be followed by a low credit expansion. This contrasts with the pre–World War II sample where a low credit recession seem to affect only the likelihood (p = 0.71) that the following recession would also be low credit. By and large, it is safe to say that the type of recession or expansion experienced seems to have very little influence on future cyclical activity.

VI. Credit and the Real Economy: A Historical and International Perspective This section follows in the footsteps of the real business cycle literature. First, we reexamine core stylized facts about aggregate fluctuations using our richer data set. Second, we study the correlation between real and financial variables, as well the evolution of these correlations over time in greater detail. The overarching question is whether the increase in the size of the financial sector discussed in previous sections left its mark on the relation between real and financial variables over the business cycle. We structure the discussion around three key insights. First, we confirm that the volatility of real variables has declined over time, specially since the mid-1980s. The origins of this so called Great Moderation, first discovered by McConnell and Pérez-Quirós (2000), are still a matter of lively debate. Institutional labor-market mechanisms, such as a combination of deunionization and skill-biased technological change, are a favorite of Acemoglu, Aghion, and Violante (2001). Loss of bargaining power by workers is a plausible explanation for what happened in the United States and in the United Kingdom, yet the Great Moderation transcended these Anglo-Saxon economies, and was felt in nearly every advanced economy in our sample (cf. Stock and Watson 2005). As a result, alternative explanations have naturally gravitated toward phenomena with wider reach. Among them, some have argued for the “better policy” explanation, such as Boivin and Giannoni (2006). For others, the evolving role of commodity prices in more service-oriented economies along with more stable markets are an important factor, such as for Nakov and Pescatori (2010). Of course, sheer dumb luck, a sequence of positive shocks more precisely, is Ahmed, Levin, and Wilson’s (2004) explanation. The debate rages on. And yet, despite the moderation of real fluctuations, the volatility of asset prices has increased over the twentieth century. Second, the correlation of output, consumption, and investment growth with credit has grown substantially over time and with a great deal of variation in the timing depending on the economy considered. Credit, not money, is much more closely associated with changes in GDP, investment, and consumption today than it was in earlier, less-leveraged eras of modern economic development. Third, the correlation between price-level changes (inflation) and credit has also increased substantially and has become as close as the nexus between monetary aggregates and inflation. This too marks a change with earlier times when money, not credit, exhibited the closest correlation with inflation. We start by reporting standard deviations (volatility) and autocorrelations of variables with their first lag (persistence) of real aggregates (output, consumption, investment, current account as a ratio to GDP), as well as those of price levels and real asset prices. In keeping with standard practice in this literature, all variables have been detrended using the Hodrick-Prescott filter, which removes low-frequency movements from the data.4 Finally, we follow general practice and report results for the full sample, 1870–2013, and also present the results over the following subsamples: the gold standard era (1870–1913); the interwar period (1919–1938); the Bretton Woods period (1948–1971); and the era of fiat money and floating exchange rates (1972–2013). We exclude World War I and World War II. This split of the sample by time period corresponds only loosely to the rise of leverage on a country-by-country basis. The next section of the paper directly conditions the business cycle moments on credit-to-GDP levels for a more precise match on this dimension. A. Volatility and Persistence of the Business Cycle Two basic features of the data are reported in table 8: volatility (generally measured by the standard deviation of the log of HP-detrended annual data) and persistence (measured with the first-order serial correlation parameter). In line with previous studies, our data show that output volatility peaked in the interwar period, driven by the devastating collapse of output during the Great Depression. The Bretton Woods and free-floating eras generally exhibited lower output volatility than the gold standard period. The standard deviation of log output was about 50% higher in the pre–World War II period than after the war. The idea of declining macroeconomic fluctuations is further strengthened by the behavior of consumption and investment. Relative to gold standard times, the standard deviation of investment and consumption was 50% lower in the post–World War II years. At the same time, persistence has also increased significantly. In the course of the twentieth century, business cycles have generally become shallower and longer, as reported earlier. A similar picture emerges with respect to price-level fluctuations. In terms of price-level stability, it is noteworthy that the free-floating era stands out from the periods of fixed exchange rates with respect to the volatility of the price level. The interwar period also stands out, but both relative to the gold standard era and the Bretton Woods period, the past four decades have been marked by a much lower variance of prices. Table 8 reveals a surprising insight: contrary to the Great Moderation, the standard deviation of real stock prices has increased. As we have seen before, both output and consumption have become less volatile over the same period. The divergence between the declining volatility in consumption and output on the one hand, and increasingly volatile asset prices on the other, is also noteworthy as it seems to apply only to stock prices. The standard deviation of detrended real house prices has remained relatively stable over time. The interwar period stands out with respect to volatility of house prices because real estate prices fluctuated strongly after World War I, particularly in Europe, and then again during the Great Depression, as discussed in Knoll, Schularick, and Steger (2015). Table 8. Properties of Macroeconomic Aggregates and Asset Prices—Moments of Detrended Variables Subsample Gold Standard Interwar Bretton Woods Float Volatility (s.d.) Log real output p.c. 0.03 0.06 0.03 0.02 Log real consumption p.c. 0.04 0.06 0.03 0.02 Log real investment p.c. 0.12 0.25 0.08 0.08 Current account/GDP 1.83 2.57 1.70 1.67 Log CPI 0.09 1.11 0.09 0.03 Log real share prices 0.13 0.22 0.20 0.25 Log real house prices 0.09 0.14 0.09 0.09 Persistence (autocorrelation) Log real output p.c. 0.49 0.63 0.79 0.65 Log real consumption p.c. 0.35 0.55 0.73 0.71 Log real investment p.c. 0.47 0.57 0.57 0.66 Current account/GDP 0.30 0.20 0.21 0.43 Log CPI 0.83 0.58 0.90 0.80 Log real share prices 0.42 0.61 0.63 0.57 Log real house prices 0.46 0.50 0.60 0.75 What about the behavior of different expenditure components over time? Table 9 shows that key empirical relationships established in the earlier literature are robust to our more comprehensive data set. Consumption is about as volatile as output (in terms of relative standard deviations), although less so in the United States. However, investment is consistently more volatile than output (more than twice as much). Table 9 also shows that these relationships hold for virtually all countries and across subperiods. There is some evidence that the relative volatility of investment and government spending is declining over time. Table 9. Properties of National Expenditure Components—Moments of Differenced Variables Full sample Pre-WWII Post-WWII Float United States Pooled United States Pooled United States Pooled United States Pooled Standard Deviations Relative to Output sd(c)/sd(y) 0.77 1.05 0.77 1.09 0.72 1.01 0.94 1.02 sd(i)/sd(y) 5.20 3.41 5.54 3.70 2.86 2.82 2.68 3.22 sd(g)/sd(y) 2.74 2.77 2.32 2.94 4.27 2.35 1.67 1.73 sd(nx)/sd(y) 0.62 1.73 0.70 2.01 0.54 1.41 0.60 1.37 Correlations with Output corr(c,y) 0.87 0.73 0.90 0.72 0.69 0.75 0.90 0.82 corr(i,y) 0.70 0.59 0.77 0.59 0.20 0.59 0.82 0.82 corr(g,y) −0.10 0.00 −0.29 −0.03 0.43 0.10 −0.28 −0.06 corr(nx,y) −0.18 −0.15 −0.14 −0.11 −0.34 −0.24 −0.62 −0.33 We also confirm that consumption and investment are procyclical with output. This comovement seems to increase over time, potentially reflecting better measurement. In contrast to consumption and investment, government expenditures exhibit much less of a systematic tendency to comove with output, suggesting perhaps a fiscal smoothing mechanism at work. Net export changes are also only weakly correlated with output movements. Overall, with more and better data we confirm a number of key stylized facts from the literature. Output volatility has declined over time, consumption is less, and investment considerably more volatile than output, and both comove positively with output. Government spending and net exports generally fluctuate in a way less clearly correlated with output. Despite broad-based evidence of declining amplitudes of real fluctuations, the volatility of real asset prices has not declined—and, in the case of stock prices, actually increased in the second half of the twentieth century relative to the pre–World War II period. B. Credit, Money, and the Business Cycle Evaluating the merits of alternative stabilization policies is one of the key objectives of macroeconomics. It is therefore natural to ask how the cross-correlations of real and financial variables have developed over time. In Table 10, we track the correlations of credit as well as money growth rates with output, consumption, investment, and asset price growth rates. Thus, looking now at first differences, the main goal is to determine if and how these correlations have changed over time, especially with the sharp rise of credit associated with the financial hockey stick. Table 10. Real Money and Credit Growth: Cross Correlations with Real Variables Full Sample Pre-WWII Post-WWII Float United States Pooled United States Pooled United States Pooled United States Pooled Real money growth Δy 0.36 0.20 0.47 0.12 0.24 0.33 0.22 0.29 Δc 0.33 0.20 0.35 0.08 0.50 0.36 0.47 0.32 Δi 0.17 0.11 0.25 0.06 −0.02 0.21 0.07 0.24 Δhp 0.16 0.30 0.11 0.24 0.26 0.33 0.22 0.27 Real credit growth Δy 0.40 0.21 0.30 0.04 0.67 0.53 0.76 0.46 Δc 0.34 0.25 0.21 0.11 0.68 0.52 0.80 0.48 Δi 0.15 0.20 0.10 0.10 0.52 0.42 0.63 0.46 Δhp −0.01 0.37 −0.18 0.29 0.41 0.45 0.55 0.49 These correlations have become larger. Table 10 shows that before World War II the correlations of credit growth and output growth were positive but low. In the post–World War II era, the correlations between credit and real variables have increased substantially, doubling from one period to the other. This pattern not only holds for credit and output. It is even more evident for investment and consumption, which were only loosely correlated with movements in credit before World War II. Unsurprisingly, in light of the dominant role played by mortgage lending in the growth of leverage, the correlation between credit growth and house price growth has never been higher than in the past few decades. The comparison with the cross-correlation of monetary aggregates with real variables shown in Table 10 echoes our previous research (Jordà et al. 2015). In the age of credit, monetary aggregates come a distant second when it comes to the association with macroeconomic variables. Real changes in M2 were more closely associated with cyclical fluctuations in real variables than credit before World War II. This is no longer true in the postwar era. As Table 10 demonstrates, in recent times changes in real credit are generally much more tightly aligned with real fluctuations than those of money. The growing importance of credit is also a key finding of this part of the analysis. In Table 11 we study the relationship between private credit, broad money, and price inflation. Are changes in the nominal quantity of broad money or changes in credit volumes more closely associated with inflation? Before World War II, broad money is generally more closely associated with inflation than credit. Moreover, the relationship between monetary factors and inflation appears relatively stable over time. Correlation coefficients are between 0.4 and 0.55 for all subperiods. Table 11. Nominal Money and Credit Growth: Cross Correlations with Inflation Broad money growth (M2 or similar) Private credit growth (bank loans) Country Full Pre-WWII Post-WWII Float Full Pre-WWII Post-WW2 Float AUS 0.52 0.27 0.40 0.49 0.51 0.23 0.40 0.44 BEL −0.07 — −0.07 −0.07 0.41 0.39 0.32 0.49 CAN 0.57 0.51 0.51 0.70 0.50 0.46 0.33 0.65 CHE 0.35 0.33 0.13 0.10 0.29 0.30 0.20 0.22 DEU 0.49 0.59 0.17 0.48 0.22 0.32 0.08 0.52 DNK 0.42 0.33 0.39 0.38 0.43 0.35 0.39 0.47 ESP 0.61 0.25 0.54 0.74 0.29 −0.20 0.36 0.45 FIN 0.34 0.20 0.41 0.66 0.41 0.36 0.40 0.52 FRA 0.48 0.44 0.41 0.45 0.39 0.16 0.68 0.63 GBR 0.61 0.46 0.38 0.44 0.58 0.45 0.38 0.49 ITA 0.51 0.47 0.38 0.73 0.48 0.49 0.28 0.66 JPN 0.43 0.01 0.58 0.61 0.54 0.47 0.72 0.53 NLD 0.33 0.36 0.14 0.31 0.66 0.65 0.41 0.49 NOR 0.57 0.43 0.49 0.60 0.60 0.61 0.33 0.48 PRT 0.70 0.81 0.64 0.71 0.33 0.19 0.42 0.50 SWE 0.53 0.60 0.26 0.29 0.65 0.66 0.44 0.56 USA 0.53 0.61 0.21 0.27 0.51 0.67 −0.02 0.25 Pooled 0.51 0.43 0.46 0.55 0.43 0.34 0.44 0.54 The growing correlation between credit and inflation rates is noteworthy. In the pre–World War II data, the correlation between loan growth and inflation was positive, but relatively low. In the post–World War II era, correlation coefficients rose and are of a similar magnitude to those of money and inflation. The mean correlation increased from 0.33 in the pre–World War II era to 0.54 in the free-floating period. Clearly, both nominal aggregates exhibit a relatively tight relation with inflation, but here too the importance of credit appears to have been growing.