You are looking for information, articles, knowledge about the topic nail salons open on sunday near me macd osc on Google, you do not find the information you need! Here are the best content compiled and compiled by the https://chewathai27.com/to team, along with other related topics such as: macd osc Macd la gì, macd indicator, macd oscillator exponential, macd signal line color, 50 – 100 day macd oscillator, signal line in macd, macd divergence, macd histogram buy sell signal

Table of Contents

MACD Oscillator – Guide to Moving Average Convergence Divergence

- Article author: corporatefinanceinstitute.com

- Reviews from users: 43561

Ratings

- Top rated: 3.6

- Lowest rated: 1

- Summary of article content: Articles about MACD Oscillator – Guide to Moving Average Convergence Divergence The MACD Oscillator is used to examine short-term moving average convergence and divergence. The MACD Oscillator is a double-edged technical … …

- Most searched keywords: Whether you are looking for MACD Oscillator – Guide to Moving Average Convergence Divergence The MACD Oscillator is used to examine short-term moving average convergence and divergence. The MACD Oscillator is a double-edged technical … The MACD Oscillator is used to examine short-term moving average convergence and divergence. The MACD Oscillator is a double-edged technical indicator in that it offers traders and analysts the ability to follow trends in the market, as well as gauge the momentum of price changes.

- Table of Contents:

macd osc

- Article author: school.stockcharts.com

- Reviews from users: 33781

Ratings

- Top rated: 3.5

- Lowest rated: 1

- Summary of article content: Articles about macd osc The MACD turns two trend-following indicators, moving averages, into a momentum oscillator by subtracting the longer moving average from the shorter one. As a … …

- Most searched keywords: Whether you are looking for macd osc The MACD turns two trend-following indicators, moving averages, into a momentum oscillator by subtracting the longer moving average from the shorter one. As a …

- Table of Contents:

Chỉ báo Trung bình động Oscillator – Hữu ích cho anh em khoái dùng chỉ báo MACD | TraderViet

- Article author: traderviet.com

- Reviews from users: 18856

Ratings

- Top rated: 4.1

- Lowest rated: 1

- Summary of article content: Articles about Chỉ báo Trung bình động Oscillator – Hữu ích cho anh em khoái dùng chỉ báo MACD | TraderViet OsMA – Trung bình động Oscillator;; MACD – Chỉ báo Moving Average Convergence/Divergence;; Signal – Đường tín hiệu. Trên đây mình đã giới thiệu … …

- Most searched keywords: Whether you are looking for Chỉ báo Trung bình động Oscillator – Hữu ích cho anh em khoái dùng chỉ báo MACD | TraderViet OsMA – Trung bình động Oscillator;; MACD – Chỉ báo Moving Average Convergence/Divergence;; Signal – Đường tín hiệu. Trên đây mình đã giới thiệu … Chỉ báo Trung bình động Oscillator là gì?

Trung bình động Oscillator (Moving Average of Oscillators – OsMA) là chỉ báo kỹ thuật thể hiện động lực của… - Table of Contents:

Chỉ báo Trung bình động Oscillator là gì

Chỉ báo Trung bình động Oscillator – Thêm ở đâu trên Meta Trader 4

Chỉ báo Trung bình động Oscillator – Cách áp dụng vào trading

Chỉ báo Trung bình động Oscillator – Tính toán như thế nào

Sơ cấp về VSA (Volume Spread Analysis) – Công cụ của chuyên gia

Moving Average Convergence Divergence (MACD) Definition

- Article author: www.investopedia.com

- Reviews from users: 38767

Ratings

- Top rated: 4.7

- Lowest rated: 1

- Summary of article content: Articles about Moving Average Convergence Divergence (MACD) Definition Chaikin Oscillator is a technical analysis tool used to measure the accumulation and distribution of moving average convergence-divergence (MACD). more. …

- Most searched keywords: Whether you are looking for Moving Average Convergence Divergence (MACD) Definition Chaikin Oscillator is a technical analysis tool used to measure the accumulation and distribution of moving average convergence-divergence (MACD). more. Moving Average Convergence Divergence (MACD) is defined as a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

- Table of Contents:

What Is Moving Average Convergence Divergence (MACD)

MACD Formula

Learning From MACD

MACD vs Relative Strength

Limitations of MACD

Example of MACD Crossovers

Example of Divergence

Example of Rapid Rises or Falls

How Do Traders Use Moving Average Convergence Divergence (MACD)

Is MACD a Leading Indicator or a Lagging Indicator

What Is a MACD Positive Divergence

/141251781-5bfc2b9c46e0fb005144de21.jpg)

MACD – Wikipedia

- Article author: en.wikipedia.org

- Reviews from users: 1523

Ratings

- Top rated: 3.8

- Lowest rated: 1

- Summary of article content: Articles about MACD – Wikipedia The MACD indicator(or “oscillator”) is a collection of three time series calculated from historical price data, most often the closing price. These three series … …

- Most searched keywords: Whether you are looking for MACD – Wikipedia The MACD indicator(or “oscillator”) is a collection of three time series calculated from historical price data, most often the closing price. These three series …

- Table of Contents:

Contents

Terminology[edit]

Mathematical interpretation[edit]

Trading interpretation[edit]

See also[edit]

References[edit]

Navigation menu

MACD: MACD Oscillator in TTR: Technical Trading Rules

- Article author: rdrr.io

- Reviews from users: 16439

Ratings

- Top rated: 3.2

- Lowest rated: 1

- Summary of article content: Articles about MACD: MACD Oscillator in TTR: Technical Trading Rules The MACD was developed by Gerald Appel and is probably the most popular price oscillator. The MACD function documented in this page compares a fast moving … …

- Most searched keywords: Whether you are looking for MACD: MACD Oscillator in TTR: Technical Trading Rules The MACD was developed by Gerald Appel and is probably the most popular price oscillator. The MACD function documented in this page compares a fast moving … The MACD was developed by Gerald Appel and is probably the most popular price

oscillator. The MACD function documented in this page compares a fast moving

average (MA) of a series with a slow MA of the same series. It can be used

as a generic oscillator for any univariate series, not only price. - Table of Contents:

Description

Usage

Arguments

Details

Value

Note

Author(s)

References

See Also

Examples

Related to MACD in TTR

Chỉ báo Moving Average of Oscillator (OsMA) là gì?

- Article author: cryptoviet.com

- Reviews from users: 21570

Ratings

- Top rated: 4.6

- Lowest rated: 1

- Summary of article content: Articles about Chỉ báo Moving Average of Oscillator (OsMA) là gì? Trong đó: OsMA – Trung bình động Oscillator;; MACD – Chỉ báo Moving Average Convergence / Divergence;; Signal – Đường tín hiệu. …

- Most searched keywords: Whether you are looking for Chỉ báo Moving Average of Oscillator (OsMA) là gì? Trong đó: OsMA – Trung bình động Oscillator;; MACD – Chỉ báo Moving Average Convergence / Divergence;; Signal – Đường tín hiệu. Chỉ báo tín hiệu Moving Average of Oscillator (OsMA) hay còn được gọi là Chỉ báo Trung bình trượt Osillator được coi là một trong những công cụ giúp trader

- Table of Contents:

OsMA là gì

Công thức tính OsMA

Cách sử dụng OsMA cơ bản

Áp dụng trong biểu đồ Forex

Sidebar chính

See more articles in the same category here: Chewathai27.com/to/blog.

MACD Oscillator – Technical Analysis

MACD Oscillator – Technical Analysis Moving Average Convergence Divergence Written by CFI Team Updated October 22, 2021

What is the MACD Oscillator?

The Moving Average Convergence Divergence (MACD) oscillator is one of the most popular and widely used technical analysis indicators that traders and analysts use to gauge momentum in markets.

Traders and analysts use a variety of technical indicators to spot trends in the market, anticipate potential shifts in trading, and, ultimately to either trade successfully themselves or to offer advice to clients so that they may trade successfully.

What is the MACD?

The popularity of the MACD indicator can be directly linked to its ability to calculate and indicate rapid short-term momentum increases or decreases.

Gerald Appel developed the Moving Average Convergence Divergence in the latter part of the seventies. While the name seems long and complicated, it is one of the least complicated indicators to actually calculate and put practically into application.

The Moving Average Convergence Divergence utilizes two different trend tracking indicators – moving averages – and creates a momentum oscillator from them by subtracting the moving average of the longer time period from the moving average of the shorter time period. In a sense, this makes the MACD a double-edged technical indicator in that it offers traders and analysts the ability to follow trends in the market, as well as to gauge the momentum of price changes.

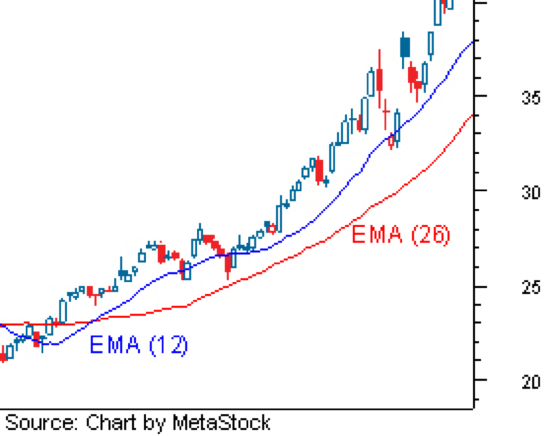

The calculated moving averages will inevitably converge, cross over one another, and then proceed to diverge, or move away from each other, making the MACD jump over and under the zero line as this happens. Traders are then able to watch for these signaling crossovers and divergences in order to help them spot changing market trends, either bullish or bearish. Sometimes explaining the MACD with words gets confusing. Take a look at the picture below.

Learn more at https://www.metastock.com/

Free MACD Excel Model Download Access our free MACD Excel template, start practicing your modeling skills today! First Name *

Email * Δ

How is MACD calculated?

The picture above clearly illustrates how shorter-term and longer-term moving averages come closer together (converge), move further apart (diverge), and cross over one another. The MACD reflects the changing relationship of short-term exponential moving averages to long-term exponential moving averages.

The equation used to calculate the MACD is as follows:

(12 day EMA – 26 day EMA) = MACD

Traders and analysts typically use closing prices for 12-day and 26-day time periods to generate the EMAs used to calculate the Moving Average Convergence Divergence. Following this, a 9-day moving average for the MACD line itself is then plotted alongside the indicator to serve as the signaling line that will help illuminate when a market may be turning.

The picture above clearly indicates the Moving Average Convergence Divergence line, the signaling line, as well as the MACD histogram, which is a representation of the difference between the 9-day moving average and the MACD. When the MACD Oscillator line crosses above the 9-day average (signaling line), the histogram reads as positive (above the zero line indicated on the right-hand side of the MACD window). Conversely, the histogram is negative when the MACD dips below the signaling line.

As we mentioned earlier, 12-period and 26-period values are the generally used settings to calculate the MACD. Changes in the time periods used for calculation can be made to accommodate a trader’s specific trade goals or their particular style of trading.

How to interpret the MACD?

As we’ve already covered, the MACD is built on movement – the movement of moving averages either towards one another (convergence) or away from one another (divergence). The Moving Average Convergence Divergence indicator fluctuates, or oscillates, over and under the zero line, otherwise known as the centerline. This fluctuation is a crossover which signals to traders that the shorter moving average has crossed the path of the longer one.

The MACD is seen as positive when the 12-day moving average crosses above the 26-day average. As the shorter-term moving average diverges and moves further and further from the longer-term one, the positive values of the Moving Average Convergence Divergence increase. This is an indication that upside momentum is rising. With this in mind, it’s not a stretch to understand that when the opposite happens, the 12-day average dips below the 26-day average, the Oscillator turns negative, and as the shorter-term moving average moves further downward away from the longer-term moving average, an increase in downside momentum is indicated.

Crossing the Signal Line

Crossovers of the signal line by the Moving Average Convergence Divergence line are one of the indicator’s staple signals. The signal line, as we’ve covered already, is the 9-day moving average of the MACD line itself. The signal line is an estimated valuation for the movement of the oscillator that makes bullish and bearish MACD turns easier to see.

When a trader sees that the Moving Average Convergence Divergence turns north, crossing over the signal line, and continues or stays above it, a bullish crossover has occurred. This is a signal that a security’s price is on the rise.

The exact opposite is true when the Moving Average Convergence Divergence crosses down over the signal line. This is a bearish crossover and if the Oscillator continues to drop below the signal line, it’s a good indication that the bears are taking over. Depending on the steepness of the drop and the number of days the drop continues, many traders may prefer to sell before they lose a significant amount of value. This is also a great time for savvy traders to pick up undervalued securities that are potential gold once a bullish market returns.

Moving Average Divergence

The MACD is frequently watched by analysts for signs of divergence from the movement of price. When price continues rising to a new high level but the MACD does not follow suit – instead turning south. This divergence from price action is commonly interpreted as a sign of impending trend change. In fact, many traders use the MACD solely as a possible trend change indicator, always watching for such divergence from price action.

The Bottom Line

Any time the signal line is crossed over at either extremely high or extremely low points, be cautious before you act. Similarly, if a crossover seems shallow, or seems to move either up or down but then plateaus, be vigilant but don’t make a move in haste. The volatility in an underlying security can be deceptive and cause the MACD to move in unusual ways.

As with anything, putting the MACD into practice and working with it on a regular basis will allow you to get a feel for its common patterns and movements, and will help you sharpen your eye when it comes to extreme or uncommon fluctuations. The longer you work with the Oscillator, the easier it will be to interpret its signals properly and trade successfully.

More about technical analysis

Divergence Oscillator) [ChartSchool]

MACD (Moving Average Convergence/Divergence Oscillator)

Introduction

Developed by Gerald Appel in the late seventies, the Moving Average Convergence/Divergence oscillator (MACD) is one of the simplest and most effective momentum indicators available. The MACD turns two trend-following indicators, moving averages, into a momentum oscillator by subtracting the longer moving average from the shorter one. As a result, the MACD offers the best of both worlds: trend following and momentum. The MACD fluctuates above and below the zero line as the moving averages converge, cross and diverge. Traders can look for signal line crossovers, centerline crossovers and divergences to generate signals. Because the MACD is unbounded, it is not particularly useful for identifying overbought and oversold levels. Note: MACD can be pronounced as either “Mac-Dee” or “M-A-C-D.” Here is an example chart with the MACD indicator in the lower panel:

Click here to see a live version of the chart.

Calculation

MACD Line: (12-day EMA – 26-day EMA) Signal Line: 9-day EMA of MACD Line MACD Histogram: MACD Line – Signal Line The MACD line is the 12-day Exponential Moving Average (EMA) less the 26-day EMA. Closing prices are used for these moving averages. A 9-day EMA of the MACD line is plotted with the indicator to act as a signal line and identify turns. The MACD Histogram represents the difference between MACD and its 9-day EMA, the signal line. The histogram is positive when the MACD line is above its signal line and negative when the MACD line is below its signal line. The values of 12, 26 and 9 are the typical settings used with the MACD, though other values can be substituted depending on your trading style and goals.

Interpretation

As its name implies, the MACD is all about the convergence and divergence of the two moving averages. Convergence occurs when the moving averages move towards each other. Divergence occurs when the moving averages move away from each other. The shorter moving average (12-day) is faster and responsible for most MACD movements. The longer moving average (26-day) is slower and less reactive to price changes in the underlying security. The MACD line oscillates above and below the zero line, which is also known as the centerline. These crossovers signal that the 12-day EMA has crossed the 26-day EMA. The direction, of course, depends on the direction of the moving average cross. Positive MACD indicates that the 12-day EMA is above the 26-day EMA. Positive values increase as the shorter EMA diverges further from the longer EMA. This means upside momentum is increasing. Negative MACD values indicate that the 12-day EMA is below the 26-day EMA. Negative values increase as the shorter EMA diverges further below the longer EMA. This means downside momentum is increasing. In the example above, the yellow area shows the MACD line in negative territory as the 12-day EMA trades below the 26-day EMA. The initial cross occurred at the end of September (black arrow) and the MACD moved further into negative territory as the 12-day EMA diverged further from the 26-day EMA. The orange area highlights a period of positive MACD values, which is when the 12-day EMA was above the 26-day EMA. Notice that the MACD line remained below 1 during this period (red dotted line). This means the distance between the 12-day EMA and 26-day EMA was less than 1 point, which is not a big difference.

Signal Line Crossovers

Signal line crossovers are the most common MACD signals. The signal line is a 9-day EMA of the MACD line. As a moving average of the indicator, it trails the MACD and makes it easier to spot MACD turns. A bullish crossover occurs when the MACD turns up and crosses above the signal line. A bearish crossover occurs when the MACD turns down and crosses below the signal line. Crossovers can last a few days or a few weeks, depending on the strength of the move. Due diligence is required before relying on these common signals. Signal line crossovers at positive or negative extremes should be viewed with caution. Even though the MACD does not have upper and lower limits, chartists can estimate historical extremes with a simple visual assessment. It takes a strong move in the underlying security to push momentum to an extreme. Even though the move may continue, momentum is likely to slow and this will usually produce a signal line crossover at the extremities. Volatility in the underlying security can also increase the number of crossovers. The chart below shows IBM with its 12-day EMA (green), 26-day EMA (red) and the 12,26,9 MACD in the indicator window. There were eight signal line crossovers in six months: four up and four down. There were some good signals and some bad signals. The yellow area highlights a period when the MACD line surged above 2 to reach a positive extreme. There were two bearish signal line crossovers in April and May, but IBM continued trending higher. Even though upward momentum slowed after the surge, it was still stronger than downside momentum in April-May. The third bearish signal line crossover in May resulted in a good signal.

Centerline Crossovers

Centerline crossovers are the next most common MACD signals. A bullish centerline crossover occurs when the MACD line moves above the zero line to turn positive. This happens when the 12-day EMA of the underlying security moves above the 26-day EMA. A bearish centerline crossover occurs when the MACD moves below the zero line to turn negative. This happens when the 12-day EMA moves below the 26-day EMA. Centerline crossovers can last a few days or a few months, depending on the strength of the trend. The MACD will remain positive as long as there is a sustained uptrend. The MACD will remain negative when there is a sustained downtrend. The next chart shows Pulte Homes (PHM) with at least four centerline crosses in nine months. The resulting signals worked well because strong trends emerged with these centerline crossovers. Below is a chart of Cummins Inc (CMI) with seven centerline crossovers in five months. In contrast to Pulte Homes, these signals would have resulted in numerous whipsaws because strong trends did not materialize after the crossovers. The next chart shows 3M (MMM) with a bullish centerline crossover in late March 2009 and a bearish centerline crossover in early February 2010. This signal lasted 10 months. In other words, the 12-day EMA was above the 26-day EMA for 10 months. This was one strong trend.

Divergences

Divergences form when the MACD diverges from the price action of the underlying security. A bullish divergence forms when a security records a lower low and the MACD forms a higher low. The lower low in the security affirms the current downtrend, but the higher low in the MACD shows less downside momentum. Despite decreasing, downside momentum is still outpacing upside momentum as long as the MACD remains in negative territory. Slowing downside momentum can sometimes foreshadow a trend reversal or a sizable rally. The next chart shows Google (GOOG) with a bullish divergence in October-November 2008. First, notice that we are using closing prices to identify the divergence. The MACD’s moving averages are based on closing prices and we should consider closing prices in the security as well. Second, notice that there were clear reaction lows (troughs) as both Google and its MACD line bounced in October and late November. Third, notice that the MACD formed a higher low as Google formed a lower low in November. The MACD turned up with a bullish divergence and a signal line crossover in early December. Google confirmed a reversal with a resistance breakout. A bearish divergence forms when a security records a higher high and the MACD line forms a lower high. The higher high in the security is normal for an uptrend, but the lower high in the MACD shows less upside momentum. Even though upside momentum may be less, upside momentum is still outpacing downside momentum as long as the MACD is positive. Waning upward momentum can sometimes foreshadow a trend reversal or sizable decline. Below we see Gamestop (GME) with a large bearish divergence from August to October. The stock forged a higher high above 28, but the MACD line fell short of its prior high and formed a lower high. The subsequent signal line crossover and support break in the MACD were bearish. On the price chart, notice how broken support turned into resistance on the throwback bounce in November (red dotted line). This throwback provided a second chance to sell or sell short. Divergences should be taken with caution. Bearish divergences are commonplace in a strong uptrend, while bullish divergences occur often in a strong downtrend. Yes, you read that right. Uptrends often start with a strong advance that produces a surge in upside momentum (MACD). Even though the uptrend continues, it continues at a slower pace that causes the MACD to decline from its highs. Upside momentum may not be as strong, but it will continue to outpace downside momentum as long as the MACD line is above zero. The opposite occurs at the beginning of a strong downtrend. The next chart shows the S&P 500 ETF (SPY) with four bearish divergences from August to November 2009. Despite less upside momentum, the ETF continued higher because the uptrend was strong. Notice how SPY continued its series of higher highs and higher lows. Remember, upside momentum is stronger than downside momentum as long as the MACD is positive. The MACD (momentum) may have been less positive (strong) as the advance extended, but it was still largely positive.

Conclusion

The MACD indicator is special because it brings together momentum and trend in one indicator. This unique blend of trend and momentum can be applied to daily, weekly or monthly charts. The standard setting for MACD is the difference between the 12- and 26-period EMAs. Chartists looking for more sensitivity may try a shorter short-term moving average and a longer long-term moving average. MACD(5,35,5) is more sensitive than MACD(12,26,9) and might be better suited for weekly charts. Chartists looking for less sensitivity may consider lengthening the moving averages. A less sensitive MACD will still oscillate above/below zero, but the centerline crossovers and signal line crossovers will be less frequent. The MACD is not particularly good for identifying overbought and oversold levels. Even though it is possible to identify levels that are historically overbought or oversold, the MACD does not have any upper or lower limits to bind its movement. During sharp moves, the MACD can continue to over-extend beyond its historical extremes. Finally, remember that the MACD line is calculated using the actual difference between two moving averages. This means MACD values are dependent on the price of the underlying security. The MACD values for a $20 stocks may range from -1.5 to 1.5, while the MACD values for a $100 may range from -10 to +10. It is not possible to compare MACD values for a group of securities with varying prices. If you want to compare momentum readings, you should use the Percentage Price Oscillator (PPO), instead of the MACD.

Using with SharpCharts

The MACD can be set as an indicator above, below or behind a security’s price plot. Placing the MACD “behind” the price plot makes it easy to compare momentum movements with price movements. Once the indicator is chosen from the drop-down menu, the default parameter setting appears: (12,26,9). These parameters can be adjusted to increase or decrease sensitivity. The MACD Histogram appears with the indicator or can be added as a separate indicator. Setting the signal line to 1 or leaving it blank, i.e. (12,26,1) or (12,26), will remove the MACD Histogram and the signal line. A separate signal line, without the histogram, can be added by choosing “Exp. Moving Avg” from the Advanced Options Overlays menu. Click here for a live chart of the MACD indicator.

Suggested Scans

Here are some sample scans that StockCharts members can use to scan for various MACD signals:

MACD Bullish Signal Line Cross

This scan reveals stocks that are trading above their 200-day moving average and have a bullish signal line crossover in MACD. Notice that MACD is required to be negative to ensure this upturn occurs after a pullback. This scan is just meant as a starter for further refinement. [type = stock] AND [country = US] AND [Daily SMA(20,Daily Volume) > 40000] AND [Daily SMA(60,Daily Close) > 20] AND [Daily Close > Daily SMA(200,Daily Close)] AND [Yesterday’s Daily MACD Line(12,26,9,Daily Close) < Daily MACD Signal(12,26,9,Daily Close)] AND [Daily MACD Line(12,26,9,Daily Close) > Daily MACD Signal(12,26,9,Daily Close)] AND [Daily MACD Line(12,26,9,Daily Close) < 0] MACD Bearish Signal Line Cross This scan reveals stocks that are trading below their 200-day moving average and have a bearish signal line crossover in MACD. Notice that MACD is required to be positive to ensure this downturn occurs after a bounce. This scan is just meant as a starter for further refinement. [type = stock] AND [country = US] AND [Daily SMA(20,Daily Volume) > 40000] AND [Daily SMA(60,Daily Close) > 20] AND [Daily Close < Daily SMA(200,Daily Close)] AND [Yesterday's Daily MACD Line(12,26,9,Daily Close) > Daily MACD Signal(12,26,9,Daily Close)] AND [Daily MACD Line(12,26,9,Daily Close) < Daily MACD Signal(12,26,9,Daily Close)] AND [Daily MACD Line(12,26,9,Daily Close) > 0] For more details on the syntax to use for MACD scans, please see our Scan Syntax Reference in the Support Center.

Additional Resources

Stocks & Commodities Magazine Articles

Moving Average Convergence Divergence (MACD)

What Is Moving Average Convergence Divergence (MACD)?

Moving average convergence divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA.

The result of that calculation is the MACD line. A nine-day EMA of the MACD called the “signal line,” is then plotted on top of the MACD line, which can function as a trigger for buy and sell signals. Traders may buy the security when the MACD crosses above its signal line and sell—or short—the security when the MACD crosses below the signal line. Moving average convergence divergence (MACD) indicators can be interpreted in several ways, but the more common methods are crossovers, divergences, and rapid rises/falls.

Key Takeaways Moving average convergence divergence (MACD) is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA.

MACD triggers technical signals when it crosses above (to buy) or below (to sell) its signal line.

The speed of crossovers is also taken as a signal of a market is overbought or oversold.

MACD helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening.

0:39 Moving Average Convergence Divergence – MACD

MACD Formula

MACD = 12-Period EMA − 26-Period EMA \text{MACD}=\text{12-Period EMA }-\text{ 26-Period EMA} MACD=12-Period EMA − 26-Period EMA

MACD is calculated by subtracting the long-term EMA (26 periods) from the short-term EMA (12 periods). An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points.

The exponential moving average is also referred to as the exponentially weighted moving average. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period.

Learning From MACD

The MACD has a positive value (shown as the blue line in the lower chart) whenever the 12-period EMA (indicated by the red line on the price chart) is above the 26-period EMA (the blue line in the price chart) and a negative value when the 12-period EMA is below the 26-period EMA. The more distant the MACD is above or below its baseline indicates that the distance between the two EMAs is growing.

In the following chart, you can see how the two EMAs applied to the price chart correspond to the MACD (blue) crossing above or below its baseline (dashed) in the indicator below the price chart.

Image by Sabrina Jiang © Investopedia 2020

MACD is often displayed with a histogram (see the chart below) which graphs the distance between the MACD and its signal line. If the MACD is above the signal line, the histogram will be above the MACD’s baseline. If the MACD is below its signal line, the histogram will be below the MACD’s baseline. Traders use the MACD’s histogram to identify when bullish or bearish momentum is high.

Image by Sabrina Jiang © Investopedia 2020

MACD vs. Relative Strength

The relative strength indicator (RSI) aims to signal whether a market is considered to be overbought or oversold in relation to recent price levels. The RSI is an oscillator that calculates average price gains and losses over a given period of time. The default time period is 14 periods with values bounded from 0 to 100.

MACD measures the relationship between two EMAs, while the RSI measures price change in relation to recent price highs and lows. These two indicators are often used together to provide analysts a more complete technical picture of a market.

These indicators both measure momentum in a market, but, because they measure different factors, they sometimes give contrary indications. For example, the RSI may show a reading above 70 for a sustained period of time, indicating a market is overextended to the buy-side in relation to recent prices, while the MACD indicates the market is still increasing in buying momentum. Either indicator may signal an upcoming trend change by showing divergence from price (price continues higher while the indicator turns lower, or vice versa).

Limitations of MACD

One of the main problems with divergence is that it can often signal a possible reversal but then no actual reversal actually happens—it produces a false positive. The other problem is that divergence doesn’t forecast all reversals. In other words, it predicts too many reversals that don’t occur and not enough real price reversals.

“False positive” divergence often occurs when the price of an asset moves sideways, such as in a range or triangle pattern following a trend. A slowdown in the momentum—sideways movement or slow trending movement—of the price will cause the MACD to pull away from its prior extremes and gravitate toward the zero lines even in the absence of a true reversal.

Example of MACD Crossovers

As shown on the following chart, when the MACD falls below the signal line, it is a bearish signal that indicates that it may be time to sell. Conversely, when the MACD rises above the signal line, the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum. Some traders wait for a confirmed cross above the signal line before entering a position to reduce the chances of being “faked out” and entering a position too early.

Crossovers are more reliable when they conform to the prevailing trend. If the MACD crosses above its signal line following a brief correction within a longer-term uptrend, it qualifies as bullish confirmation.

Image by Sabrina Jiang © Investopedia 2020

If the MACD crosses below its signal line following a brief move higher within a longer-term downtrend, traders would consider that a bearish confirmation.

Image by Sabrina Jiang © Investopedia 2020

Example of Divergence

When the MACD forms highs or lows that diverge from the corresponding highs and lows on the price, it is called a divergence. A bullish divergence appears when the MACD forms two rising lows that correspond with two falling lows on the price. This is a valid bullish signal when the long-term trend is still positive.

Some traders will look for bullish divergences even when the long-term trend is negative because they can signal a change in the trend, although this technique is less reliable.

Image by Sabrina Jiang © Investopedia 2020

When the MACD forms a series of two falling highs that correspond with two rising highs on the price, a bearish divergence has been formed. A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue.

Some traders will watch for bearish divergences during long-term bullish trends because they can signal weakness in the trend. However, it is not as reliable as a bearish divergence during a bearish trend.

Image by Sabrina Jiang é Investopedia 2020

Example of Rapid Rises or Falls

When the MACD rises or falls rapidly (the shorter-term moving average pulls away from the longer-term moving average), it is a signal that the security is overbought or oversold and will soon return to normal levels. Traders will often combine this analysis with the relative strength index (RSI) or other technical indicators to verify overbought or oversold conditions.

Image by Sabrina Jiang © Investopedia 2020

It is not uncommon for investors to use the MACD’s histogram the same way they may use the MACD itself. Positive or negative crossovers, divergences, and rapid rises or falls can be identified on the histogram as well. Some experience is needed before deciding which is best in any given situation because there are timing differences between signals on the MACD and its histogram.

How Do Traders Use Moving Average Convergence Divergence (MACD)? Traders use MACD to identify changes in the direction or severity of a stock’s price trend. MACD can seem complicated at first glance, since it relies on additional statistical concepts such as the exponential moving average (EMA). But fundamentally, MACD helps traders detect when the recent momentum in a stock’s price may signal a change in its underlying trend. This can help traders decide when to enter, add to, or exit a position.

Is MACD a Leading Indicator, or a Lagging Indicator? MACD is a lagging indicator. After all, all of the data used in MACD is based on the historical price action of the stock. Since it is based on historical data, it must necessarily “lag” the price. However, some traders use MACD histograms to predict when a change in trend will occur. For these traders, this aspect of the MACD might be viewed as a leading indicator of future trend changes.

So you have finished reading the macd osc topic article, if you find this article useful, please share it. Thank you very much. See more: Macd la gì, macd indicator, macd oscillator exponential, macd signal line color, 50 – 100 day macd oscillator, signal line in macd, macd divergence, macd histogram buy sell signal